INTRODUCTION

Behavioral economics examines how people make decisions while considering a wide range of factors, including psychological, cultural, and emotional aspects, and addressing issues that carry greater weight than monetary questions, such as education, health, environment, crime, public policies, and retirement. In particular, it analyzes the importance of cognitive biases in human decisions and how certain stimuli leverage these nudges to incentivize/disincentivize certain options for eco-nomic agents.

The history of economics has been dominated by classical economic theory that operates under a rational understanding of expectations and decisions, despite many choices taking place in an imperfect information scenario. It is common to label as "heterodox" all those approaches that differ from the classical economics school. For instance, the JEL Classification System of the American Economic Association does not include BE as a recognized discipline.1 Nevertheless, several alternative approaches to the classical mainstream question the assumptions of the classic model: Marxist, developmentalist, Keynesians, institutionalist, behaviorist, etc.

Although BE has been increasingly adopted by social researchers during the first part of the 21st century the question remains as to what must be understood by an intervention based on a BE approach. Geiger (2017) confirms the rise of academic interest and use of BE but does not state whether it holds a uniform methodological approach. The present contribution will benefit other scientists following BE methodology and reveal whether it opens alternative paths for their research in the social field. Furthermore, it will help intensify the application of the method by governments and organizations since the existing statistics regarding BE implementation leave room for expansion. Another motivation is to support the generalization of the discipline in the academic sector The presence of BE in university and business school syllabi will benefit from normalizing the use of the approach in economic and social research. In summary, the effectiveness of BE interventions is the central topic under discussion, and most points of view seem optimistic regarding the contribution of nudge units. However, there is still space to debate about the characteristics of what can be properly labeled as a BE methodological framework, associated or not with the neoclassical approach.

Our main hypothesis here is to assert that BE must be considered a doctrine on its own, demonstrating that it has a distinctive methodology followed by an ever-growing group of social researchers. To test this hypothesis, we perform a qualitative evaluation of a sample of 20 recent representative articles on BE. These contributions were identified by searching for crucial elements of the nudging process, using the keyword "nudge," following the scheme of Thaler and Sunstein (2008).

We have not found up to date any specific scheme that provides a recognized method to develop BE studies. There have been partial attempts, as in the cases of Benson and Manoogian (2021) and The Decision Lab (2020), which we will mention in section 4, but their reach has been scant or isolated. We have chosen the study by Thaler and Sunstein (2008), a turning point for BE, as they were awarded a Nobel prize in 2017 for their contributions. This book is the most relevant study in con-temporary publications on BE; hence, we will use it as a reference to demonstrate that other recent articles are following a similar or identical methodology.

In the second section, we offer a descriptive analysis of how BE separates from classical economic theory, which has held sway over the last three centuries. We then present some optimistic data about the increasing application of BE in research on social issues by "nudge units," which have been created in several countries to apply BE in public policies.

Next, we examine the discussion about the hypothesis of this article in the literature review section, describing different positions regarding the relevance and singularity of BE. Finally, we conclude by returning to the main motive driving us to produce this paper, which may be summed up as a desire to improve the impact and reach of public policies, social projects, and academic programs through using BE.

A BRIEF HISTORY OF BEHAVIORAL ECONOMICS

Behavioral economics has solid precedents in the history of economic thought. The theory of choice in microeconomics has been historically a function of three factors: income level, prices, and preferences. As income depends on the agent's background and prices in the market, the theory of utility has been a battlefield for various economic approaches to determine how preferences are built and, consequently, choices made.

For classical economics, preferences result from the rational decisions of the agent who maximizes their utility according to a budget restriction. The agent is conscious of how much utility each option yields and has all the necessary information about the market and products to maximize their own utility ("selfishness"). In addition, the agent is able to rank their preferences and prefers more quantity to less.

Adam Smith and David Ricardo explained the benefits unleashed by these assumptions about individual decisions on society as a whole in The Wealth of Nations (Smith, 1937) and Principies of Political Economy and Taxation (Ricardo, 2018). On the normative level, both authors defend free individual choice and laissez-faire to make possible the most efficient and prosperous economic system, illustrated by Smith's intuitive "invisible hand" and Ricardo's law of comparative advantage.

BE challenges the notion that individuals always act rationally, deciding with all the relevant information and maximizing the utility function for their particular benefit. While the concept of utility for classical economics is individual, rational, and foreseeable, BE assumes the existence of common well-being, bounded rationality, and cognitive biases, the three pillars to explain the unorthodox agent's choice theory that BE represents.

Starting with the first, the reformist utilitarianism of Bentham, Stuart Mill, and Chadwick during the eighteenth and nineteenth centuries argued for a concept of collective utility that advocates the decisions of people and public policies in favor of common happiness, not only individual satisfaction (Kahneman et al., 1997). Particularly, Edwin Chadwick described with accuracy the situation of vast areas of Great Britain in terms of sanitary conditions and lack of security (Ekelund & Hébert, 2006), for which the economic model based on the free individual choice on its own, endorsed by the classical theory of utility, had not been able to provide well-being or development.

Regarding rationality, it was in the twentieth century when Katona (1951) first contradicted the rationality of the classical model, stating that it only happened on rare occasions and that the context of the decision was rather spontaneous and sentiment-dominant. This was an essential step in merging economics with psychology to examine economic problems, the first ideas of which had already been present in Adam Smith's "Theory of the moral sentiments" (Smith, 2010), who mentioned the significance of psychology and cognitive biases in the decisions of economic agents.

Bounded rationality is partly due to the absence of perfect information declared by the classical model. Simon-considered the first behaviorist economist honored with a Nobel prize (1978)-projected a theory of choice based on an organizational context with asymmetric information, where agents make decisions according to the limited options they distinguish under human cognitive limitations (Simon, 1955). Akerlof (1970) portrayed in his "peaches and lemons market" how difficult market dynamics made it to estimate the quality of products for the consumer, in an additional contribution that diminished the perfect information assumption. Finally, Kahneman and Tversky (1979) described in their prospect theory a decision sequence where heuristics produced by biases, such as the framing effect or loss aversion, play a vital role in the end choice. They also identified other relevant biases in the decision process, such as representativeness, availability, and anchoring.

Unlike classical economics, prospect theory demonstrated that people make decisions based on the reference they possess instead of maximizing utility in a perfect market under full rationality. For instance, if your close friends or your personal experience tell you that the usual price for a good is X, this is the first price you will use as a reference to estimate expensiveness or cheapness, independently of the market price. Thus, decision-makers are not more "econs" but humans, in the words of Thaler and Sunstein (2008), for whom utility calculation turns out to be less rational than classical economics would expect. Kahneman and Tversky (1979) added and demonstrated numerous biases and heuristics that situated the decision much further from rationality.

Akerlof and Kranton (2010) further explored markets working with asymmetric information and coined the notion of "identity economics" to refer to a utility function where "identity" is the second key component of the decision, besides monetary incentives. Identity can be understood as the definition of who economic agents feel they are, that is, their social category (ethnicity, social class, urban tribes, or nationality would be examples to consider), the dominant norms associated with this category, and the consequent behavior. Therefore, one's sense of belonging (family, friends, neighborhood, affiliations, etc.) would determine their social and consumption choices, not rationality or income.

"Nudge" by Thaler and Sunstein

Thaler and Sunstein (2008) popularized the distinction between cognitive system 1 (or automatic) and cognitive system 2 (or reflective). This concept served as a bridge to reconcile both views of choice (rational and sentiment-like). They argued that decisions frequently take place in system 1, where people are primarily exposed to biases. These biases drive them to use heuristics to decide instead of using the rational system 2. Kahneman (2011) extensively developed the implications of these systems in the decision-making process and the consequences of heuristics in making flawed decisions.

Most decisions are made using system 1, which inadvertently guides people through routines, avoiding dangers, and following habits (dressing up, walking on the street, using the remote control, typing, browsing the Internet, etc.), as if on autopilot. However, we call system 2 thinking when rational decisions are required, such as solving a math problem, participating in a debate, or managing changes.

They added the concepts of choice architecture and nudge to the BE framework. If decision-makers are subject to bounded rationality, biases, and heuristics, then choice architects will have the opportunity to influence people to find an option more attractive than others. They will be able to use nudges to leverage heuristics to drive humans towards a correct choice, which can be more beneficial than people deciding on their own.

The logic of nudges applies, for example, when the supermarket draws a green arrow on the floor to guide people to the fresh food area. The excess of information in shops (availability bias) and the omnipresent temptations of fast food and beverages (framing bias) could lead them to not making the best choice. Nevertheless, a simple green path might trigger their system 2 and remind them of the importance of a healthy diet in the shopping cart.

Consequently, nudges open the door for libertarian paternalism (Thaler & Sunstein, 2008), a similar approach to utilitarianism (Kahneman et al., 1997) and opposed to laissez-faire, where the choice architect can model the context where decisions take place to obtain more beneficial results for the decision-maker and the rest of society.

They classified nudges using the word as an acronym: iNcentives, Understand mapping, Defaults, Give feedback, Expect error, and Structure complex choices. For example, when the administration recommends that citizens save for their retirement, they can provide short-term fiscal benefits (incentives), implement calculators to estimate their future income (mapping), automatically opt employees in for savings programs (defaults), inform periodically about their retirement fund balance (feedback), send reminders to all 45-year-old citizens (expect error), or present three main options for them to save (structure).

These examples of nudges constitute an excellent tool for authorities to orient the behavior of people whenever they respect three basic rules: nudges are not coercive (norms), manipulative (power), or costly (budget). Their contributions define a sequence of BE applications in modern economics and will be further employed in this article to examine whether new papers tagged as "behavioral economics" do follow a common methodology.

The decade 2011-2020 seemed to become the golden era for BE. Daniel Kahneman and Vernon Smith were awarded the Nobel prize in 2002, and the first Behavioral Insight Unit (nudge unit) was created in the UK in 2009 under public patronage to advise the administration in deploying public policies. Subsequently, Thaler, one of Kahneman's pupils, was honored again in 2017, which should confirm the definitive ascent of BE in the field of economics.

We are about to verify this consolidation, considering that BE is a relatively young approach in the history of economic thought. There are only a few explicit mentions of it in the handbooks of the history of economics published in the last decade of the twentieth century (Ekelund & Hébert, 2006).

A growing presence of behavioral economics: Academic practice and nudge units

Together with academic relevance, the scope of practical implementation on social issues is also key to evaluating the impact of BE. This second component is even more critical for a discipline with a normative vocation that found space in the incapability of the classical model to explain certain consumer choices.

Nudge units were created as think tanks to design and execute initiatives under BE methodologies, initially as administration units but progressively also as private agencies. They were expected to perform as an executing arm of the discipline. Halpern (2015) narrates the story of the first nudge unit in the UK from the inside. Its prolific activity reached different public policy fields and proved the effectiveness of the BE approach in projects, providing remarkable savings for the British administration since 2010.

There is abundant literature endorsing the effectiveness of nudge units in the last decade. Bernatzi et al. (2017) review a large sample of studies employing the BE approach and positively assess the work of nudge units in the UK and the US during the previous years in both effectiveness and efficiency, albeit recommending the generalization of ways to measure the impact of interventions.

Thaler and Sunstein (2008) primarily assess the critical role of nudging in the development of the discipline, opening an ambitious project to study public interventions in social issues like health care, income distribution, and urban de-sign. Sunstein (2018) is more precise in articulating and defending the idea of institutionalizing nudge units as a way to expand the discipline and, at the same time, provide an extended classification of nudges over the previous work by Thaler. On his part, Thaler (2016) clings to the view that the value of BE lies in its capability to explain the causes of social phenomena in conjunction with other social sciences like psychology, calling for the acceptance of the pre-eminent role of economics as an empirical science independent of theoretical justification, and, therefore, endorsing the role of nudge units.

A third plank in the platform to support the development of BE would be the networks of academics and professionals. They were founded in many cities to promote the applicability and benefits of the BE approach. London, Stockholm, Vienna, Zurich, and Auckland are some of the most representative examples (OECD, 2019).

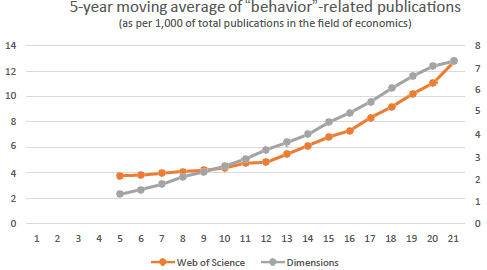

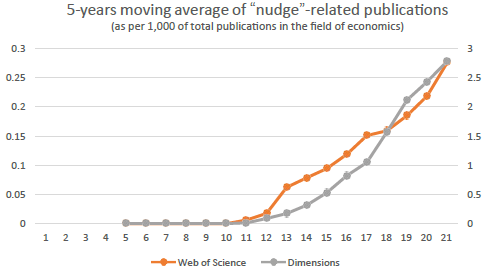

The development and consolidation of BE have meant that it now occupies a primary place in academic publications. Geiger (2017) has demonstrated an in-creasing number of mentions of the most relevant works on BE in main economic journals, and Angner (2019) shows a similar growth of BE in the publications of the Allied Social Science Association (ASSA) and Google Books. Figure 1 and 2 shows the number of publications containing terms related to "behavioral economics" and "nudge unit" from the search engines of two notable knowledge databases: Web of Science2 and Dimensions.ai3 for the period 2000-2020. Both graphs show a clear growth of BE references in the academic literature since the beginning of the century.

Source: Author's elaboration based on Dimensions (https://app.dimensions.ai) and Web of Science (https://webofknowledge.com); data exported on January 21, 2021.

Figure 1 Moving average (previous 5years) of "behavior"-related publications 5-year moving average of "behavior"-related publications

Source: Author's elaboration based on Dimensions (https://app.dimensions.ai) and Web of Science (https://webofknowledge.com); data exported on January 21, 2021.

Figure 2 Moving average (previous 5years) of "nudge"-related publications 5-years moving average of "nudge"-related publications

Table 1 shows the same information about references to BE but as a proportion of total references for "economics" on the same date and in the same databases. The results show that not only the number of articles on BE has grown, but also the weight and importance of BE in the field of economics have increased exponentially in recent decades. The proportion of "behavior"-related publications in "economics" grew from 1.33 to 7.32 according to Dimensions, and 3.78 to 12.80 according to Web of Science, in the period 2000-2020, considering the moving average of the last 5 years. On the other hand, mentions of "nudge" as a proportion of the total publications in the field of "economics" grew from 0.01 (2010) to 2.71 (2020) according to Dimensions and from 0.01 to 0.28 according to Web of Science (Table 1).

Table 1 Number of publications, as per 1,000 of total publications in the field of economics (5-year moving average)

| Year | "Behavior"-related | "Nudge"-related | ||

|---|---|---|---|---|

| Web of Science | Dimensions | Web of Science | Dimensions | |

| 2004 | 3.78 | 1.33 | 0.00 | 0.00 |

| 2005 | 3.81 | 1.54 | 0.00 | 0.00 |

| 2006 | 3.96 | 1.77 | 0.00 | 0.00 |

| 2007 | 4.11 | 2.12 | 0.00 | 0.00 |

| 2008 | 4.20 | 2.33 | 0.00 | 0.00 |

| 2009 | 4.40 | 2.59 | 0.00 | 0.00 |

| 2010 | 4.75 | 2.91 | 0.01 | 0.01 |

| 2011 | 4.83 | 3.33 | 0.02 | 0.09 |

| 2012 | 5.48 | 3.66 | 0.06 | 0.17 |

| 2013 | 6.16 | 4.02 | 0.08 | 0.32 |

| 2014 | 6.83 | 4.57 | 0.09 | 0.53 |

| 2015 | 7.33 | 5.00 | 0.12 | 0.82 |

| 2016 | 8.35 | 5.50 | 0.15 | 1.05 |

| 2017 | 9.19 | 6.09 | 0.16 | 1.57 |

| 2018 | 10.22 | 6.64 | 0.19 | 2.12 |

| 2019 | 11.08 | 7.09 | 0.22 | 2.43 |

| 2020 | 12.80 | 7.32 | 0.28 | 2.79 |

Source: Author's elaboration based on Dimensions (https://app.dimensions.ai) and Web of Science (https://webofknowledge.com); data exported on January 21, 2021.

A second factor that shows evidence of the relevance of BE is its growing and wide application as a major method in public and private projects in economic research (Gawlowski, 2019). Table 2 shows a representative list of nudge unit reports elaborated by the principal international organizations and business units working on BE. Three properties characterize the application of BE through these nudge units:

Private and public applications: There is a notorious use of BE methods by public units, private organizations, and professional networks.

Multi-sector: The scope of the projects reaches several fields (healthcare, education, legal, service delivery, environment, taxes, crime, etc.) and territories (counting on several agencies or teams on a sub-national level).

Continuous: There has been an uninterrupted activity of projects based on BE in the last decadTable 2. Nudge unit reports

Table 2 Nudge unit reports

| BEworks. (2020). Our approach. https://beworks.com/what-we-do/#our-approach |

| Behavioural Exchange. (2018, June). Behavioural insights for public policy. Case studies from around Australia. https://behaviouraleconomics.pmc.gov.au/sites/default/files/resources/behaviouralinsights-public-policy.pdf |

| Behavioural Insights Netwerk Nederland. (2019, January 11). Rijk aan gedragsinzichten. https://www.rijksoverheid.nl/documenten/rapporten/2019/11/01/bijlage-rapport-rijk-aan-gedragsinzichteneditie-2019 |

| Behaviourally Informed Organizations (BI-Org). (2019). About the partnership. https://www.biorgpartnership.com/the-project-full |

| European Central Bank. (2020). The BEAR Toolbox. https://www.ecb.europa.eu/pub/research/working-papers/html/bear-toolbox.en.html |

| Government of Ontario. (2018, March 1). Behavioural Insights in Ontario: Update Report 2018. https://www.ontario.ca/page/behavioural-insights-ontario-update-report-2018 |

| OECD. (2017). Behavioural Insights and Public Policy: Lessons from Around the World. Paris: OECD Publishing. https://doi.org/10.1787/9789264270480-en |

| Rotman School of Management. (2020). Behavioral Economics in Action at Rotman (BEAR). https://www.rotman.utoronto.ca/FacultyAndResearch/ResearchCentres/BEAR |

| Samson, A., ed. (2018). The Behavioral Economics Guide 2018 (with an introduction by Robert Cialdini). https://www.behavioraleconomics.com/be-guide/the-behavioral-economics-guide-2018/ |

| Samson, A., ed. (2020). The Behavioral Economics Guide 2020 (with an introduction by Colin Camerer). https://www.behavioraleconomics.com/be-guide/the-behavioral-economics-guide-2020/ |

| TEN - The European Nudging Network. (2017). Nudge Database. https://oecd-opsi.org/toolkits/theeuropean-nudging-network/ |

| The Behavioral Science Team. (2019, March). Annual Report (FY 2017 and FY 2018). Ministry of the Environment, Government of Japan. http://www.env.go.jp/earth/ondanka/nudge/report1_Eng.pdf |

| The World Bank - EMBED Unit. (2019). Behavioral science around the world: Profile of 10 countries. http://documents.worldbank.org/curated/en/710771543609067500/Behavioral-Science-Aroundthe-World-Profiles-of-10-Countries |

| United Nations. (2016, December 16). Behavioural Insights at the United Nations. Achieving Agenda 2030. https://www.undp.org/publications/behavioural-insights-united-nations-%E2%80%93-achieving-agenda-2030 |

Table 3 shows a list of countries where BE is implemented through nudge units. These countries gather most of the mentions in the most extensive reports by nudge units, international organizations, and BE networks. There are mainly seven countries with a significant application of the behavioral insight approach demonstrating the three conditions mentioned above: the UK, Australia, Netherlands, Denmark, Japan, USA, and Canada.

Table 3 Most relevant countries applying behavioral economics methodologies (2011-2020)

| Countiy | Private and public | Multi-sector | Continuous |

|---|---|---|---|

| Australia | X | X | X |

| Canada | X | X | X |

| Denmark | X | X | X |

| Japan | X | X | X |

| Netherlands | X | X | X |

| UK | X | X | X |

| USA | X | X | X |

| Belgium | X | ||

| Finland | X | ||

| France | |||

| Germany | X | ||

| Ireland | X | ||

| Italy | X | ||

| Norway | X | ||

| Peru | X | ||

| Singapore | X | X | |

| Spain | X | ||

| Sweden | X | ||

| Other | Austria, Switzerland, Israel |

Source: Author's

There is also ample literature on other countries listed, but they do not fulfill the three conditions. For example, Sweden seems to have declined their publications since 2015, Peru basically employs behavioral interventions in education, and Belgium does not hold, among European Union countries, a permanent network or major institution to be considered. Singapore is largely using BE, but essentially in government ministries and departments. France has applied BE in some of its public projects, like Germany, and has an active specialized private company (BVA) and a developing network, Nudge France.

HYPOTHESIS AND METHODOLOGY

The behavioral label may be concealing a heterogeneous understanding of the method. Criticism of the neoclassical model seems to be one of the common factors of studies in BE. A considerable part of BE literature has tried to prove its validity in relation to the neoclassical model, underlining the particularities and contributions to be considered a parallel or complementary approach. Other analyses have focused on demonstrating that it is a successful method to explain things that the traditional model does not achieve. For instance, Terziev and Kanev (2018) have declared that the neoclassical approach is insufficient to tackle social problems, where BE proves to be superior.

Despite the basic concepts described by Battaglio et al. (2019), based on studies by Katona, Tversky, Kahneman, Thaler, and others, some authors drew attention to the fact that BE should provide a common methodological framework to deploy research. Similarly, although recognizing the significant contributions of BE in recent decades compared to previous economic approaches, Barberis (2018) highlights the question of whether BE will remain as a discipline or merge with other social sciences.

Pesendorfer (2006) sustains that, in the light of Camerer and Loewenstein (2003), BE is an established discipline-mainly based on the delimitation of biases and their effect on the context of the decision-but remains dependent on standard economics to analyze general issues. Thus, it would constitute a necessary supplement for specific cases subject to psychological biases.

Smith (2016) places the interest in BE on the benefits of learners and researchers to obtain more accurate insights into the analysis of social problems related to public policies, sharing part of the purpose of this study. Hummel and Maedche (2019) have researched the effectiveness of nudges and argue for a more formal way to evaluate BE interventions. They contribute to the theoretical framework by providing a classification of nudges that can also be useful for building new studies. It represents a clear attempt to improve formalization and rigor in the practice of BE.

Similarly, Alcott and Kessler (2019) are concerned about the social benefits of nudging as a primary factor for the importance of BE and detail a specific intervention that can be evaluated as socially and economically beneficial. In turn, Gawlowski (2019) treats BE as a discipline associated with public policies. He insists on the role of nudge units from a merely practical point of view. Therefore, they sustain the instrumentalization of BE to obtain results independently of its homogeneous formalization. The work of Benartzi et al. (2017) points in the same direction and has become one of the most robust and wide-ranging studies demonstrating the possibilities of BE to strengthen public policies. Roberto and Kawachi (2015) present multiple cases where BE was successfully employed-specifically in healthcare-to deal with problems, make decisions, and establish policies.

Therefore, not all experts seem to be concerned about the relationship bet-ween BE and the classical model to prove the validity and effectiveness of BE. While Maialeh (2019) argues that although BE contributes to an empirical level, it does not modify the neoclassical framework, Angner (2019) recognizes that BE trans-forms the economic analysis and, consequently, proposes an integration of both perspectives. Jones (2018), for whom BE contributions are numerous and evident, does not allude to this dichotomy but recommends a broader integration with new advances in other disciplines like psychology and biology. Berg (2014) presents a similar evaluation; nevertheless, in this case, a specific integration with sociology is proposed to understand how the same decision contexts affect different groups.

Our main hypothesis here is that BE must be considered a doctrine on its own, validating that it holds a distinctive methodology followed by a growing group of social researchers. The hypothesis of this article helps clarify in this debate whether BE has gained an exclusive space in economics to be the basis of research methods to face social investigations.

Next, we shall perform a qualitative evaluation of a sample of recent representative BE articles, searching for key elements present in the selected papers to test the above hypothesis.

Sample of papers for qualitative analysis

Using the Scopus database, a search was run on September 29, 2021, to find contributions published in economics and tagged under "behavioral economics" from 2017 to 2021.4 A total of 353 results were sorted by the number of citations. To mitigate the logical preponderance of articles from 2017 due to longer exposure to other investigations and to have a proper representation of newer articles, another search was run exclusively for 2020 (the last complete year)5; 74 articles were found, which were also sorted by citation numbers.

Among the results labeled with "behavioral economics," we performed an in-depth evaluation of their adequacy to the objectives of our qualitative study to identify the articles with the most citations that used an experimental method congruent with the behavioral economics method. A total of 4 articles from 2020 and 16 from the period 2017-2021 were selected since the proportion of items found in the searches was 1 to 4 approximately (74/353) (Table 4).

These 20 articles were the basis of our qualitative analysis to test our hypothesis about the consistency of BE as an autonomous discipline. This analysis consisted of verifying how many fulfilled a checklist of the main elements defining BE as a discipline. We noticed in the extensive study by Battaglio et al. (2019) how well the analysis of articles works when the observation checklist is properly designed. In our case, the Nobel Prize-winning work of Thaler and Sunstein served as the basis to evaluate the articles, analyzing whether each article considered the sequential steps of nudging.

Precisely, our qualitative analysis consists of checking whether the sample of selected articles on BE incorporates a pool of items according to "Nudge" (Thaler & Sunstein, 2008), which we have described in the introduction as the most explanatory and instructive work for the application of the BE methodology. These items guided us throughout the fulfillment of the analysis:

i. Behavioral topic. The question analyzed depends on the choice of an individual agent or the aggregation of the decisions of individuals.

ii. Bias identified. The research considers the heuristics of decision-makers caused by cognitive bias, either to be avoided or leveraged.

iii. Behavioral solution. The researcher describes the desired or alternative behavior of the decision-maker when applying a nudge.

iv. Suitable to nudge. The research mentions or considers at least one of the reasons why BE can be a suitable approach to be used. To tag the rea-son, the six main cases to employ BE pointed out by Thaler and Sunstein (2008) have been used:

When Homer Simpson is stronger than Captain Spock, meaning in presence of "temptations."

When the future consequences of present decisions are uncertain.

When decisions are complex or demand that we analyze too much information.

When the situation presents us with an unusual dilemma.

When we will not have direct feedback from the decision, to correct or orientate that decision.

When we must consider externalities, positive or negative, for third parties not involved in the decision.

v. Moment of truth. The situation and environment in which the de-cision-maker selects an option or adopts a behavior are identified.

vi. Conditions observance. For BE, coercion or manipulation are not acceptable, and the interventions should not be costly.

vii. Type of nudge. The strategy to introduce the nudge is described. As for the point suitable to nudge, the classification of Thaler and Sunstein (2008) is used:

Default: In case the agent does not explicitly decide, it is understood that they choose one in particular (the best option or recommendation).

Expect error: The behavioral expectation is that the agent is going to fail in choosing the best option, so the intervention must watch over them and provide the best option.

Incentives: The behavioral intervention drives the agent to choose the best option by means of incentives.

Provide feedback: In the absence of perfect information, the behavioral intervention provides feedback for the agent to choose savvily.

New framing: The behavioral intervention sets the scenario of the decision to favor a beneficial choice for the agent.

Information relocation: The behavioral intervention orientates the decision of the agent.

viii. Success indicator. Specific indicators are provided to evaluate the intervention related to the behavior solution. As this element is a part of any research paper, it is not registered for the purpose of this article, but we confirmed that all the articles conformed.

An index from 0 to 7 was created to summarize the compliance of each article with the BE methodology, adding 1 point when the article fulfilled each element of the methodology and 0.5 when it only did so partly. Additional explanations were included for each element of each article. Therefore, an article would obtain a 7 when complying with all the characteristic elements of the behavioral economics method.

Table 4 List of twenty articles recently published for the purpose of analysis

| • Benner, M. (2020). Mitigating human agency in regional development: the behavioural side of policy processes. Regional Studies, Regional Science, 7(1), 164-182. |

| • Roll, S., Grinstein Weiss, M., Gallagher, E., & Cryder, C. (2020). Can pre commitment increase savings deposits? Evidence from a tax time field experiment. Journal of Economic Behavior & Organization, 180, 357-280 |

| • Oreopoulos, P., Petronijevic, U., Logel, C., & Beattie, G. (2020). Improving non academic student outcomes using online and text message coaching. Journal of Economic Behavior & Organization, 171, 342-360. |

| • Ozturk, O. D., Frongillo, E. A., Blake, C. E., McInnes, M. M., & Turner McGrievy, G. (2020). Before the lunch line: Effectiveness of behavioral economic interventions for pre commitment on elementary school children's food choices. Journal of Economic Behavior & Organization, 176, 597-618. |

| • Alm, J., Bloomquist, K. M., & McKee, M. (2017). When you know your neighbor pays taxes: Information, peer effects and tax compliance. Fiscal Studies, 38(4), 587-613. |

| • Alpízar, F., Nordén, A., Pfaff, A., & Robalino, J. (2017). Spillovers from targeting of incentives: Exploring responses to being excluded. Journal of Economic Psychology, 59, 87-98. |

| • Alpízar, F., Nordén, A., Pfaff, A., & Robalino, J. (2017). Unintended effects of targeting an environmental rebate. Environmental and Resource Economics, 67(1), 181-202. |

| • Bholat, D., Broughton, N., Ter Meer, J., & Walczak, E. (2019). Enhancing central bank communications using simple and relatable information. Journal of Monetary Economics, 108, 1-15. |

| • Chabe Ferret, S., Le Coent, P., Reynaud, A., Subervie, J., & Lepercq, D. (2019). Can we nudge farmers into saving water? Evidence from a randomized experiment. European Review of Agricultural Economics, 46(3), 393-416. |

| • Hanley, N., Boyce, C., Czajkowski, M., Tucker, S., Noussair, C., & Townsend, M. (2017). Sad or happy? The effects of emotions on stated preferences for environmental goods. Environmental and Resource Economics, 68(4), 821-846. |

| • Ibanez, L., Moureau, N., & Roussel, S. (2017). How do incidental emotions impact pro environmental behavior? Evidence from the dictator game. Journal of behavioral and experimental economics, 66, 150-155. |

| • Ihli, H. J., Gassner, A., & Musshoff, O. (2018). Experimental insights on the investment behavior of small scale coffee farmers in central Uganda under risk and uncertainty. Journal of Behavioral and Experimental Economics, 75, 31-44. |

| • Jetter, M., & Walker, J. K. (2017). Anchoring in financial decision making: Evidence from Jeopardy! Journal of Economic Behavior & Organization, 141, 164-1-76. |

| • Katare, B., Wetzstein, M., & Jovanovic, N. (2019). Can economic incentive help in reducing food waste: experimental evidence from a university dining hall. Applied Economics Letters, 26(17), 1448-1451. |

| • Lohse, J., Goeschl, T., & Diederich, J. H. (2017). Giving is a question of time: response times and contributions to an environmental public good. Environmental and Resource Economics, 67(3), 455-477. |

| • Malone, T., & Lusk, J. L. (2017). The excessive choice effect meets the market: A field experiment on craft beer choice. Journal of Behavioral and Experimental Economics, 67, 8-13. |

| • Payne, C., & Niculescu, M. (2018). Can healthy checkout end caps improve targeted fruit and vegetable purchases? Evidence from grocery and SNAP participant purchases. Food Policy, 79, 318-323. |

| • Pellerano, J. A., Price, M. K., Puller, S. L., & Sánchez, G. E. (2017). Do extrinsic incentives undermine social norms? Evidence from a field experiment in energy conservation. Environmental and resource Economics, 67(3), 413-428. |

| • Tebbe, E., & von Blanckenburg, K. (2018). Does willingness to pay increase with the number and strictness of sustainability labels? Agricultural Economics, 49(1), 41-53. |

| • McKee, M., Siladke, C. A., & Vossler, C. A. (2018). Behavioral dynamics of tax compliance when taxpayer assistance services are available. International Tax and Public Finance, 25(3), 722-756. |

RESULTS AND DISCUSSION

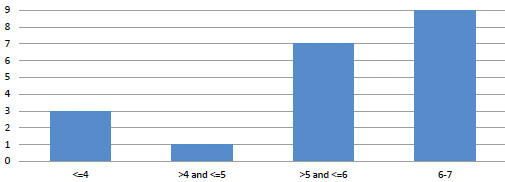

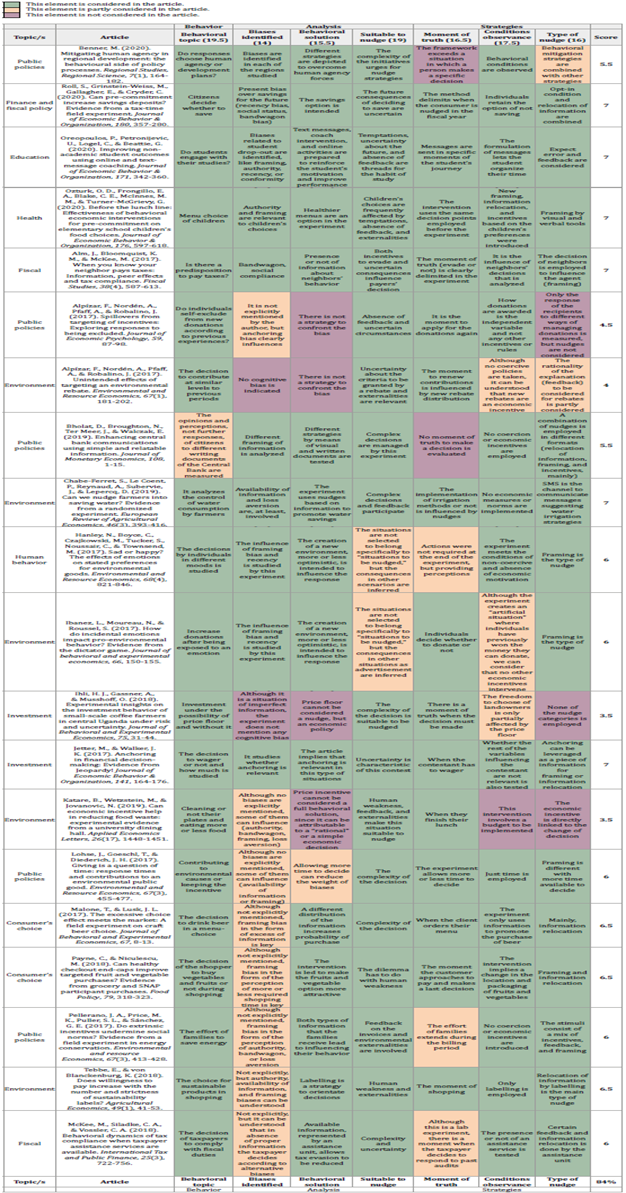

Table 5 details the qualitative evaluation for each article. We have included comments about specific compliance with each aspect indicated by Thaler and Sunstein (2008). According to this analysis, 84% of the total possible points were achieved for the total of the 20 articles (Figure 3). The result of this qualitative analysis concludes, therefore, that among the most cited and recent articles that are self-included into BE (in their keywords), there is a high compliance with the common approach indicated by Thaler and Sunstein (2008), as 16 out of 20 (80%) of the articles achieved a score higher than 5 and a total of 6 (30%) obtained the maximum.

Regarding the criteria, we found a range from 14 to 19.5 over 20 possible points in each criterion. The point of identification of biases is the one that achieved the lowest score (70%), which can even be considered notable compliance. Also, only 2 of the 20 articles presented an insufficient evaluation (3.5 score) on what can be considered an essential part of the methodology, while 6 showed a full record (7 score).

Table 5 Analysis of the twenty articles included (published 2017-2021)

Source: Author's elaboration.

Is BE a distinctive approach?

The available bibliometric data shows that BE has consolidated in the last decade (Geiger, 2017), presenting growth in its academic presence and reaching a representative role in public and private projects. Does this evidence indicate that BE is a new paradi0m of economic thinkin0?

The iain conclusion of the -qualitative analysis is that the articles receivin0 the most citations amon0 recent studies, included under BE keywords, are indeed representative of the BE approach defined by Thaler and Sunstein (2008). Thus, this BE methodolo0y presents hi0h compliance with a unique and distinctive approach. However, discussin0 these results also leads to reco0nizin0 certain weaknesses and some lack of cohesion in this approach.

One of these irre0ularities consists of the absence of a systematic pattern of deviation from neoclassical rationality; that is, the unavailability of a standard cate0orization of co0nitive biases used in the publications that could be considered of general use among researchers in the field of BE. This point scores 14/20, the lowest of the criteria employed by our methodolo0y amon0 the main co0nitive biases appearing in the 20 articles reviewed in our qualitative analysis (Table 6).

Table 6 List of main cognitive biases

| • Anchoring The person is influenced by a previous piece of information that establishes a reference which the subsequent choices willbe made. |

| • Bandwagon The person follows the decision or judgement of people in their group of influence. |

| • Authority The person attributes greater value to the opinion or recommendation of a leading figure because of their recognized position. |

| • Loss aversión The person is proportionally more concerned about possible losses than possible earnings. |

| • Confirmation of own ideas and endowment effect The person tends to follow or continue previous decisions although new relevant information or alternatives could have appeared. |

| • Availability of information The person considers that the information they currently have is enough to make a good choice instead of searching for new data. |

| • Impact The person is mainly influenced by the intensity of past experiences rather than their duration or repetition. |

| • Overconfidence The person trusts their possibilities, judgment, and wishes over facts to make a good choice. |

| • Recency The person is mainly influenced by more recent facts and tends to forget or dismiss older ones. |

| • Framing The person is influenced by the environment where and when the decision is made (mood, physical context, order, etc.). |

| • Distinction or relativeness The person takes into account a particular criterion and compares the options to decide what is the best one. |

| • Representativeness The person evaluates the options according to one of the most remarkable characteristics of them. |

Source: Author's elaboration.

Seeking to correct this lack of standard categorization of cognitive biases, Benson and Manoogian (2021) have proposed a Cognitive Bias Codex, which may become an important reference in the field of BE. However, it also has its own limitations. It has weaknesses for research purposes, such as its extension, which lacks mana0eability, presents overlays between biases and even contradictions, and does not include empirical references in its application. Similar difficulties appear when trying to work with the list of The Decision Lab (2020).

There is also some weakness in the application of nud0in0 in both private and public spheres, leaving ample room to advance. Although nudge units show progress durin0 the decade, they are still limited re0ardin0 the number of countries, sectors, and spheres (public or private). It seems that BE is at risk of becoming an academic approach, while it ori0inally had a clear devotion to bein0 an extended normative method.

Gawlowski (2019) also concluded that the strength of nudge units is still reduced and geographically limited after examining six countries (the UK, Denmark, Sweden, Australia, Canada, and the USA) that are supposed to lead in BE application. Some contributions about the strength of BE also draw attention to the requirements for real nudging. As Sunstein (2018) emphasizes, the term "nudge" can cover some policies under the umbrella of soft paternalism when they could be considered mandatory or manipulative. Regarding the concept of nudge, Schmidt and Engelen (2020) review the importance of the ethics of nudging to validate the suitability and fairness of interventions. Moreover, Sunstein (2018) summarizes the need to be consistent and transparent in consolidating BE contributions. BE must differentiate from other costly interventions (advertisement, financial incentives, etc.) and tend to minimize budgets. However, some of the research that he found included significant expenses. Finally, the criticism of Gawlowski (2019) and Alcott and Kessler (2019) can be highlighted regarding the scant information about the evaluation of BE applied projects that led them to suspect some exaggeration of the impact of nudging.

Contributions to assemble a BE intervention roadmap and standardization

One way to reinforce BE is by setting a specific theoretical scheme. OECD (2017) systematizes the process of intervention in people's decision-making in four phases:

Definition of the problem (challenge)

Identification of cognitive biases (behavioral insight)

Proposed solution (nudge)

Evaluation of the intervention (research design), including indicators to measure the impact

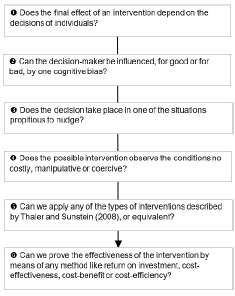

This simple route offers a method to discern whether a behavioral approach should be applied. If we integrate it, a process is proposed with the elements identified in Figure 4. When responding yes to all of them, economists will have a potential behavioral study at hand.

For example, considering the case of dealing with unjustified absences in family doctor consultations, a typical issue where BE might be applied, this could offer a solution for healthcare authorities, leveraging the biases detected:

Recency: Reminders and confirmation messages are sent to users the day before the appointment, asking them to confirm it or opt out. This allows a new booking window of 24 hours for other users.

Overconfidence: Messages are automatically sent to all users who utilized the system during the three previous months to thank them for their compliance or ask them to use the system correctly, according to their attendance records.

Authority: The doctor hands users with more than two previous absences a letter explaining the importance of proper employment of the resources of the national healthcare system when they next visit the surgery.

The proposal in Figure 4 reveals this procedure:

The intervention leaves the effect in the hands of the system's users, irrespective of their previous conduct.

Clearly, the user is influenced by recency, overconfidence, and authority biases.

When the user books their appointment, the need for it is uncertain. Also, they are not receiving feedback; whether they attend or not, it causes negative externalities to other patients (overbooking).

The three conditions apply since the nudges designed are neither coercive nor costly and can have a direct effect at the moment the user makes the last decision.

The nudges will make use particularly of providing feedback and expecting error.

Although a specific study should be designed in detail, it is possible to evaluate it by a case-control study or a field experiment to measure its impact.

Consequently, it can be concluded that similar methodological aids would be valid to examine whether a challenge is suitable to be analyzed by means of a behavioral approach with plausible results (Aliende, 2020).

We can find some examples of methodological aids in the BE literature, like EAST cards® (The Behavioural Insights Team, 2014), another framework to be employed by any behavioral economist to enhance their research, designed in the Business Insights Unit (2016). Some other institutions are working to consolidate a BE methodological framework. For instance, BI-Org (2019), BEworks (2020), the Rotman School of Management (2020), and OECD (2017) have noted this need and proposed some instruments to boost the work of architects of decisions.

All these proposals serve to the spirit of Camerer & Loewenstein (2003) when affirming that "Our hope is that behavioral models will gradually replace simplified models based on stricter rationality, as the behavioral models prove to be tractable and useful in explaining anomalies and making surprising predictions."

CONCLUSIONS

Has the contribution of BE to economics been particularly significant over the last ten years? With or without the allegiance of classical economists, it seems clear that BE has proved both its academic validity and practical impact according to its increasing presence in academic publications and the diversity of projects using nudge units, backed by recent Nobel prize winners Thaler, Kahneman, and Smith.

In this article, we offer proof that papers based on BE are consistent enough to be considered a distinctive approach. We have focused on analyzing recent pa-pers and their compliance with a common methodology; nevertheless, there are other important facts to prove the relevance of BE in contemporary research on social sciences. We have found it necessary to present a proposal to progress in the application of a unique step-by-step method, given that the main features in a behavioral study seem to be clear-judging based on the qualitative analysis of the twenty articles reviewed. Some concepts, such as cognitive biases, were interpreted discretionally by some authors.

Although we noted an increasing concern it awakens in academic journals and among policymakers, it is still necessary to study the academic penetration of BE in university syllabi as a relevant subject for undergraduate students. The interest that the discipline arouses among researchers will only have a solid continuation when it is conveyed to the entire academic community.

Besides the generalization of the approach in the academic field, the corporate sector and professional networks are surely playing a crucial role in expanding the discipline. Nudge units hold much of the merit, although their teams are still very constrained in government departments, as we have seen. It is also true that it should have had a broader global reach since it seems to be limited to certain developed and, rarely, developing countries. In addition to the existing support and application by international organizations like the UN, the OECD, the UE, and the World Bank, the role of professional and academic networks will be essential to continue the growth of BE over the next ten years.

Further research should expand methodological proposals for the BE framework and study the effectiveness of BE in comparison with previous approaches (classical economic theory, law enforcement, marketing campaigns, or other social strategies). This type of studies will also lead to taking care with evaluation methods that, according to the literature reviewed in this paper, have not always been rigorously interpreted in BE interventions.

In essence, there is a community of social scientists who, working under a more formalized and standardized methodological context, will benefit from smoothing the process of building impactful projects under BE and collaborating with other experts within the field of economics and in interdisciplinary studies