Introduction

During the first ten years of the 21st century, Argentina was a poster child for crisis management and recovery. The 1990s ended in a spectacular crisis. During the deep downturn of 1997-2001, GDP contracted by more than 20% and unemployment reached 22% of the labor force. The "Convertibility Plan", which stopped hyperinflation using a currency board, collapsed and the massive depreciation of the domestic currency (the Peso) destroyed the balance sheets of banks and triggered a public debt crisis.

In a dramatic turn of events, the economy resurged from its ashes and Argentina was able to restructure its public debt, implement a "pesification" of its domestic financial contracts (a de facto conversion of dollar denominated contracts into peso denominated contracts), while achieving a very fast growth rate (which averaged 7- 8% during the period 2003-2008). Although the rate of inflation slowly crept from around 3% to 25%, social indicators, such as poverty and unemployment rates, improved significantly during the early 2000s -see Damill et al. (2015) for further discussion-.

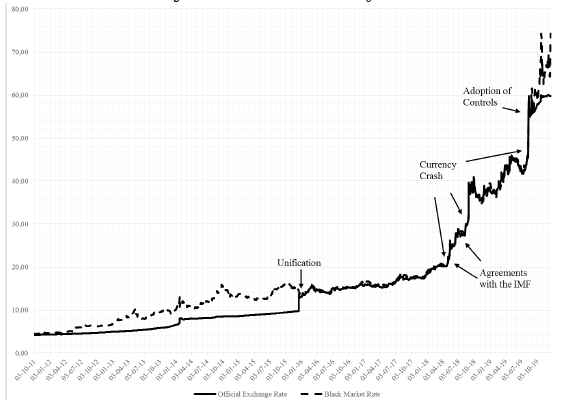

Despite the extremely favorable external context, which included both very low interest rates and high prices of commodities, towards the end of 2011 the country experienced a renewed round of exchange rate pressure (towards faster rates of depreciation).1 Because in Argentina an increase in the exchange rate has contractionary and inflationary effects, the authorities refused to let the peso depreciate sharply, opting instead to restrict the sale of foreign currency. But far from solving the original problems, these measures led to the emergence of a parallel market, and the significant gap between the official and the "black" market rate created incentives to under invoice export proceeds and to over invoice import requirements, and a slow drainage of foreign exchange reserves took place.

During 2007-2015 a series of unsolved problems and some challenges for future governments emerged, including the presence of an inefficient system of foreign exchange controls, an overvalued currency, negative real interest rates (at least for depositors), high and persistent rates of inflation, and very low relative prices for regulated goods such as transport, gas, water and electricity, which undermined the fiscal stance (due to the utilization of subsidies) and the sustainability of the external accounts (due to the large energy-related imports).

The new government that took office during December in 2015 promised during the campaign to bring the economy back to "normal". One of the first measures implemented was the removal of the capital controls, granting unlimited access to foreign currency at market determined prices. In order to tame inflation, the new administration implemented an Inflation Targeting regime with an independent central bank; because they adjusted the prices of regulated goods, increasing the inflationary pressures, at the same time, the inflation targets were not met.

An initial economic rebound generated enthusiasm among government supporters, but also from public opinion. As early as January 2016, at the World Economic Forum in Davos, Argentina announced its intentions to bid for a membership at the Organization for Economic Cooperation and Development (OECD) during the following month. With the political opposition under control, the Congress was helping the government to pass market friendly reforms and to sign a landmark agreement with the holdout creditors, which allowed Argentina to return to the bond market for the first time in almost a decade. In a nutshell, the international community and the capital markets were granting Argentina a chance to finance a fiscal and a current account deficit of roughly 5% of GDP, but it turned out that this would last only for a few years.

The authorities promised to deal with the fiscal deficit in a "gradualist fashion" (so initially there were little or no budgets cuts, and in fact some taxes where reduced), but they refused to acknowledge the complications associated with a growing current account deficit. Moreover, inflation fell very little and at a very slow pace, due to the sluggish nature of inflation and the adjustment of relative prices. Eventually, a sudden stop of international financial flow precipitated the events: during the first quarter of 2018 Argentina asked the IMF for the largest loan in the history.

This paper deals with the sequence of events that led to from the removal of the foreign exchange controls to the failed stabilization attempt based on an over-optimistic set of inflation targets. The main goal of this paper is to explore the removal of controls and the stabilization policies that followed, analyzing the stance of macroeconomic policies in order to obtain relevant policy lessons. Our main hypothesis is that the adoption of capital controls (in the form of severe foreign exchange restrictions) combined with the wrong mix of monetary and fiscal policies, created several complications; however, the decision to open the capital account contributed very little to solving the original problems and created new ones. Specifically, the combination of external and fiscal deficits, the premature adoption of Inflation Targeting and a very abrupt liberalization of financial flows created an unsustainable path for public external debt.

In order to accomplish the goals set in this paper, section 2 presents the preconditions and original economic package introduced in December 2015, while section 3 discusses the macro-economic effects of an open capital account combined with Inflation Targeting plus a flexible exchange rate. Section 4 concludes.

The December 2015 Program. Setting the Stage

Argentina has a long record of price instability that, during the 20th century, can be traced back to the second part of the 1940s. Except for most of the 1990s, inflation usually remains well above international standards and Argentina's main trading partners. During the 1950s and 1960s, inflation remained in the range of 20-30%, although it peaked more than 100% in 1958. In the 1970s and 1980s, inflation stood on the three digits terrain, with two hyperinflationary bursts towards the end of the 1980s and during the early 1990s.

During the 2008-2015 period, the rate of inflation oscillated between 15-40% per year. Although these figures may look small considering Argentina's historical record, they are clearly above all of its main trade partners and international standards. The struggle and the failure to control inflation is one the Achilles Heel of stabilization policies in Argentina. In this section we analyzed the state of the economy before the arrival of the new government, and we discuss the new policy mix implemented after December of 2015. Table 1 summarizes the dynamics of the main macroeconomic variables during 2011-2015, which corresponds to the second term of the CFK administration. The main stylized facts are the combination of slow growth with moderate but persistent inflation, a slow increase in the mean real wage at the cost of a strong appreciation of the real effective exchange rate, and a moderate but growing fiscal and current account deficits.

During the entire period, per capita GDP fell by almost 3 percentage points, while accumulated inflation was slightly above 180%. For the year 2011, the average real wage increased by about 4%, the level of real effective exchange rate fell by 33%, while fiscal and current account deficits stood at 3% at the end of 2015.

Table 1 Selected Macroeconomic Variables (2011-2015)

| Variable | Period | 2011 | 2015 | Cum. Variation |

|---|---|---|---|---|

| Growth of Per Capita GDP (constant AR$) | November | 4.6% | 1.6% | -2.9% |

| Real Effective Exchange Rate (17-12-15 = 100) | November | 113.1 | 75.4 | -33% |

| Real Effective Exchange Rate (17-12-15 = 100) | Year Average | 121.7 | 82.7 | -32% |

| Current Account / GDP | Year | -1% | -3% | -1.7 p.p. |

| Real Wage (constant 2011 AR$) | Year Average | 4131.7 | 4300.7 | 4.1% |

| Consumer Price Index | November | 339.8 | 965.0 | 184% |

| Consumer Price Index | Year Average | 315.2 | 886.2 | 181% |

| Primary Fiscal Deficit (old method) / GDP | Year | 0.2% | -1.8% | - 2 p.p. |

| Primary Fiscal Deficit (new method) / GDP | Year | -0.7% | -3.4% | -2.7 p.p. |

| Total Fiscal Deficit (old method) / GDP | Year | -1.4% | -3.1% | -1.7 p.p. |

| Total Fiscal Deficit (new method) / GDP | Year | -2.3% | -4.9% | -2.6 p.p. |

Source: own elaboration based on INDEC, Central Bank of Argentina, and Ministry of Finance.

An important problem was the slow drainage of foreign exchange reserves, even in the presence of restrictions on the purchase and sale of foreign currency. Indeed, gross reserves fell from US$ 46.376 million at the end of 2011 to US$ 31.159 million at the end of 2015, despite the presence of controls and the different attempts to arrange credit lines with the People's Bank of China. It was becoming increasingly difficult to avoid a significant depreciation of the exchange rate.

The new government that took office in December of 2015 decided to remove all the restrictions on sales of foreign currency. Capital controls were seen as an ill-suited tool to promote development2, so the new administration decided the abrupt opening of the capital account of the balance of payments. Such strategy presumed that, given the low level of indebtedness that Argentina carried then, it was possible to finance a soft transition towards a more open and stable economy, avoiding a traumatic adjustment. Indeed, capital flew in, and consequently, the stock of gross foreign exchange reserves increased from US$ 39.308 by the end of 2016 to US$ 55.055 by the end of 2017.

The regulations in place before December of 2015 were of little help to avoid a reduction in the stock of foreign exchange reserves, most likely due to the presence of other unsound macroeconomic policies (i.e., a very low real interest rate and an overvalued real exchange rate). The recent Argentinean experience is certainly an example of the ineffectiveness of some forms of capital controls (Stanley, 2018). The emergence of a black-market premium did not eliminate the pressures towards depreciation and capital flight continued, albeit at a slower pace. Between 2011 and 2015 the government engaged in a series of swap operations with the People's Bank of China to increase the foreign exchange reserves, but the foreign exchange shortage persisted, limiting the ability of domestic firms to import the critical imported inputs, as well as the scope for fiscal policy to expand domestic activity.

Another novelty was the decision to let the currency float on a more or less flexible base. Towards the end of 2015, the way forward was far clear, considering that Argentina has a long record of failed stabilization attempts. These packages usually combined different doses of "heterodox" policies, such as wage and price controls, with "market friendly" policies, such as fiscal and monetary restraints and an exchange rate adjustment. All the stabilization attempts shared the utilization of an exchange rate peg or a pre-determined rate of depreciation, usually implemented after a correction of the original parity. The new government, au contraire, considered that market participants had already adjusted their prices, so the initial depreciation would have very little impact on inflation3.

On a more general ground, the new administration arrived with the promise that the people "will not lose what they already earned". The new administration was also convinced that the low ratio of external debt to GDP, and low public debt to GDP, created room for replacing money printing with debt finance, in order to achieve simultaneously a reduction in the rate of inflation and a gradual fiscal consolidation that would presumably not hurt the most vulnerable. A reasonable rate of growth was expected, so the burden of the adjustment could be easily spread across several years. The authorities were extremely optimistic and ignored the sluggish nature of inflation (and inflation expectations), frequent and large cost shocks due to the adjustment of public sector prices and the volatility of the nominal exchange rate, and the risks associated with the opining of the capital account and the increasing level of foreign indebtedness.

A critical step towards financial liberalization took place during February of 2016, when Argentina agreed to pay a group of Italian bondholders $1.35 billion and US$ 1.1 billion to two of the six holdout firms (Montreux Partners and EM Ltd).4 By the end of the month, the government reached an understanding with the rest of the bondholders, paying them US$ 4.65 billion. An excellent deal for the investors who purchased the bonds at a heavily discounted price. A significant portion of the money raised from bond sales (roughly US$ 15 billion) was used to pay back the bondholders. Reaching fast-track agreements was a modus operandum.

The results of the 2015 program were disappointing. Output contracted during 2016 and a mild recovery took place in 2017. Inflation peaked during 2016, and it slowed down during 2017, but it always remained well above the official inflation targets. During 2018 there was a severe shortage of external finance, as private capital markets refused to roll over debt at reasonable rates, and the large depreciation that followed increased inflation and reduced output, once again. As a measure of last resort, the government started the conversations with the IMF and eventually obtained a three years Stand-By Program of 50 billion US dollars, which was later expanded and totalized 57 billion US dollars, but out of which 44 billion US dollars were eventually disbursed.

Table 2 summarizes the dynamic of the main variables during 2016-2017. The most salient facts are that per capita GDP did not recover, while inflation remained above 20%, more or less in the same level that it was during 2011-2015, and well above the target of 17% for 2017. The mean real wage was slightly above the level of 2015 despite some drastic adjustments in the price of gas, electricity, water and public transportation; there was some appreciation of the real effective real exchange rate even after an initial depreciation of the domestic currency when the controls were removed (the official rate increased from about 9 pesos per dollar to about 15 to 17 pesos per dollar), which certainly helped to maintain real wages during 2016-2017.

Table 2 Selected Macroeconomic Variables (2016-2017)

| Variable | Period | 2016 | 2017 |

|---|---|---|---|

| Growth of Per Capita GDP (constant AR$) | November | -2.9% | 1.8% |

| Real Effective Exchange Rate (17-12-15=100) | November | 88.7 | 87.1 |

| Real Effective Exchange Rate (17-12-15=100) | Year Average | 93.9 | 87.8 |

| Current Account / GDP | Year | -2.70% | -4.90% |

| Real Wage (constant 2011 AR$) | Year Average | 4124.8 | 4359.6 |

| Consumer Price Index Inflation | November | 38.8% | 21.8% |

| Consumer Price Index Inflation | Year Average | 39.7% | 23.5% |

| Primary Fiscal Deficit (old method) / GDP | Year | -2.20% | -2.47% |

| Primary Fiscal Deficit (new method) / GDP | Year | -4.20% | -5.80% |

| Total Fiscal Deficit (old method) / GDP | Year | -3.80% | -4.60% |

| Total Fiscal Deficit (new method) / GDP | Year | -3.83% | -5.93% |

Source: own elaboration based on INDEC, Central Bank of Argentina, and Ministry of Finance

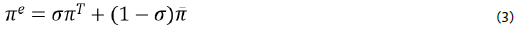

Perhaps the most impressive indicator is the large increase in the current account deficit, which was close to 5% of GDP during 2017. Total fiscal deficit (once the interest payments are included) stood above 5% of GDP. Figure 1 shows the evolution of the external account by component. The most dramatic shift after 2015 is the large increase in capital inflows that financed an increasing trade and current account deficit. During 2016-2018, the National Government issued about 229,894 (million US dollars) of total debt, while total emission foreign currency amounted 155,385 (also million US dollars), which is 2 and 1.5 times larger than the accumulated current account deficit, respectively.

Source: authors' own elaboration based on INDEC and the Central Bank of Argentina.

Figure 1 External Accounts Dynamics (millions of US dollars)

To summarize, the figures for 2016-2017 show that inflation did not come down, production and income fell during 2016 and then recover slightly during 2017, but with a growing current account deficit and fiscal deficit (especially after considering the interest on public debt) and a significant real exchange rate appreciation. The situation changed dramatically during the second quarter of 2018, when it became clear that international markets will no longer roll over the debt (never mind buy new one). A quick reversal in capital flows turned the foreign exchange market in a sellers' market and the price of the dollar overshot, from about 17 pesos per dollar in early May, to above 40 pesos per dollar in October and during the rest of 2018.

Dealing with Stubborn Inflation after the Removal of the Controls

The policies adopted after December of 2015 included not only a foreign exchange market unification, but also a "gradual" adjustment of fiscal deficit (in fact very little adjustment or no adjustment at all), an increase in tariffs and the adoption of Inflation Targeting in the context of a fully open capital account and a flexible exchange rate regime. The removal of controls was part of a broad strategy to reduce inflation without incurring in large social costs. This section explores the evolution of the recent policies that aim to control inflation, as well as the role of capital flows and exchange rate flexibility.

The goal of reducing inflation while adjusting "key" prices was extremely ambitious. Presumably, the government believed that the increased credibility of monetary policy, associated with an independent central bank, the adoption of Inflation Targeting, and the design of a more prudent fiscal policy, was enough to achieve disinflation while the price of regulated goods and the exchange rate increased. This surprising belief suggests that there was some miscalculation due to the lack of understanding of the nature of inflation in Argentina.

In order to highlight some important issues, we will briefly discuss the problem of stabilization policy under different inflation regimes to clarify some of the issues. In the literature, inflation is classified into three main regimes, "low inflation", "chronic inflation" and "hyperinflation". Some authors have analyzed episodes distinguishing between "moderate" (roughly 15-30% annual rates) and "high" inflation (above 15-30%). The consensus view is that "hyperinflation" is clearly a different regime. The so-called "moderate" and "high" inflations are usually more resilient and stable than "hyperinflation"; hence most authors include them under the rubric of "chronic inflations" (Pazos, 1972).

If moderate or high rates of inflation are sustained during long periods of time, the economy may adapt by the introduction of explicit or implicit indexation rules that tie current to past inflation. When inflation reaches extremely high levels, a sudden increase in inflation will reduce the purchasing power of those whose incomes are indexed, at least until they get a new price or wage increase, thus discouraging indexation. But as long as inflation remains moderate or high, price setting will remain non-synchronized and the rate of inflation will probably display an inertial behavior. This is because the adaptation to inflation through formal or informal indexation mechanism reduces transaction costs, and despite the losses of purchasing power that may arise during the contract, the cost of frequent re-contracting is prohibitive (except during hyperinflation).

A sound fiscal policy and an appropriate exchange rate regime are necessary but not sufficient conditions to stabilize the economy when there is some degree of price and wage indexation. The rate of inflation becomes highly depend on its recent history and a sudden shock that contracts aggregate demand may create a politically unsustainable recession. Moreover, any disruptive event, such as a large depreciation or an increase in the price of food or public utility, may permanently move the rate of inflation to a higher level (Bruno, 1988; Dornbusch & Simonsen, 1983, 1987; Frenkel, 1983; Leviathan & Pitterman, 1986).

During episodes of "chronic" inflation it is hard to establish a nominal anchor because inflation "may live a life of its own" divorced (at least temporarily) from the evolution of the nominal exchange rate or the money supply (Bruno, 1993). During hyperinflations, prices usually follow the nominal exchange rate, so there is an open door for a quick stabilization of inflation, most likely by adopting a hard peg (Heymann & Leijonhufvud, 1995).

The duration of contracts depends on the rate of inflation, and after some large shocks, unions and other sectors may push to shorten them. The shorter the duration of contracts, the larger the impact of any shock on the level of inflation, and the stronger the pressures to shorten the duration (Taylor, 1993, chapter 4). For example, a large increase in the price of foreign goods or the removal of subsidies that kept down the price of some goods will reduce the purchasing power of wages. Eventually, unions will demand higher incomes the next bargaining round or they may seek to set their wage twice every year (if they were adjusted, for instance, once per year). If the duration of contracts becomes very short, the publication of consumer price indexes (which is published with some delay) is eventually replaced by the quotation of the exchange rate. Dornbusch (1985) labeled this endogenous adjustment of the duration of contracts the "Pazos-Simonsen mechanism".

Dealing with high and moderate inflation requires a careful assessment of the process of wages and price formation. Movements of relative prices could also have important inflationary consequences, particularly among emerging market economies (Blejer, 1983; Olivera, 1960). Price adjustments on administrative prices could be a major source of inflation among emerging market economies, particularly when in transition towards a more deregulated economy.

It is known that Inflation Targeting may not work when expectations are poorly anchored or when there is not enough coordination between the Treasury and the Central Bank. This is the classical problem of "time inconsistency", which typically arises when there is tension between the fiscal and monetary policies. Most models that describe how Inflation Targeting operates usually assume a "passive" fiscal policy (which implies that the budget constrain of the government is satisfied for all price paths, see Woodford, 2003).

The presence of "chronic inflation" may produce a slow convergence of expected inflation to the target, possibly with some important output costs, thus rendering Inflation Targeting an ineffective mechanism to achieve disinflation (Calvo, 2017), even in the presence of an adequate fiscal policy. Inflation Targeting works mainly as a lock-in strategy, which was mainly implemented once inflation was brought below 10-20% by other means (Di Tella, 2019), except during very few instances.5

Nowadays about 30 countries use Inflation Targeting (Hammond, 2011; Roger, 2010). Most of the time the targets were adopted once inflation was close to the goal of 2-3% per year, and other times to reduce inflation from at most 10% per year. Inflation Targeting was never implemented to deal with "chronic inflation", and it was an ill-suited approach to solve Argentina's main problems. Some of those lessons were missing in the package adopted between 2015 and 2019.

The Elimination of the FX Controls

Despite the underlying difficulties to achieve stabilization during episodes of moderate or high inflation, the new authorities were extremely optimistic. This is striking, given the bad record of previous stabilization attempts (except those that include a credible fixed exchange rate), which usually ended in a collapse of the exchange rate and a financial crisis. As we argued, the new policy regime was novel in two ways. It was the first time that Argentina attempted to control inflation without an exchange rate peg, and it was the first Inflation Targeting regime adopted while inflation remained high. Perhaps the authorities believed that by resorting to a more flexible regime, the exchange rate would take care of the external accounts. However, the combination of increasing external government indebtedness plus a very strict inflation target created enormous pressures towards real appreciation, and a large and unsustainable current account deficit emerged.

As previously discussed, when inflation is moderate or high, the rate of inflation may exhibit some inertia due to the presence of formal and informal indexation schemes, and consequently these abrupt adjustments of relative prices are associated with an acceleration of the rate of inflation. For instance, after a large nominal exchange depreciation, the rate of inflation reached an annual rate of 45% during October of 2016.

The removal of capital controls allowed a large inflow of capital that financed a growing and significant current account deficit of about 4-5% of GDP. Because disinflation cannot be achieved overnight, assessing the dynamics of the current account becomes a crucial factor to analyze the sustainability of Inflation Targeting in Argentina.6

The authorities elected during 2015 believed that the process of unification of the foreign exchange market would have no effect on prices. A quick look at the evidence suggests that this is hardly the case. A glimpse at the data suggests that almost all the cases where the premium falls (the difference between the black market and the official rate), the official exchange rate increases.7 An increase in the price with a large tradable component, such as food and energy, should clearly be expected.

Table 3 compiles data on official and black-market rates of depreciation from Ilzetki et. al. (2017). Every time the premium falls below three given thresholds (10%, 20% and 30%) we consider that the foreign exchange market was "unified". We then look at the rates of depreciation of the official and the black-market rate.

Table 3 Depreciations after Unifications

| Cases | Mean Rate of Depreciation | |

| Official Depreciation (premium < 30%) | 598 | 17.94% |

| Black Market Depreciation (premium < 30%) | 463 | -2.27% |

| Official Depreciation (premium < 20%) | 746 | 13.21% |

| Black Market Depreciation (premium < 20%) | 619 | -2.72% |

| Official Depreciation (premium < 10%) | 1036 | 7.15% |

| Black Market Depreciation (premium < 10%) | 919 | -2.93% |

Source: own elaboration based on the dataset constructed by Ilzetzki et al. (2017).

Table 3 shows that the official rate depreciations between three and eight times the rate at which the black market appreciates (on average).8 It is interesting to point out that the official exchange rate climbs towards the black market (which on average suffers a small appreciation). The idea that most prices were already set at the black-market rate parity, and the presidential decision to eliminate foreign exchange restrictions as soon as possible, played an important role in this regard.

The removal of the foreign exchange restrictions and the implementation of a more or less freely floating exchange rate regime9 were combined with an increase in the price of regulated prices, a gradual reduction of the fiscal deficit and the replacement of money printing with foreign indebtedness to cover the public sector expenses, and the formal adoption of Inflation Targeting. Macroeconomic policies lack the adequate coordination and relied on the idea that changes in key prices will have negligible inflationary effects, provided that credible and sound monetary and fiscal policy were adopted.

The new administration minimized the side effects of the unification of the exchange rate market, by assuming that the domestic price levels already included the effects of the depreciation. Although if the public expects an exchange rate unification, some domestic prices may already be set at the higher parity (Calvo 1983), this is not true of "flex" price goods or those goods that are fully tradable. In fact, the price of food was closely related to the evolution of the official exchange rate while controls were present, and consequently, they increased sharply after the foreign exchange market unification.

After the removal of the controls, the authorities claimed that the exchange rate was allowed to float freely and that monetary policy would follow a strict Inflation Targeting approach. In Argentina, the instrument is the rate associated with central bank short-term instruments, first the so-called "Lebacs" (Letras del Banco Central) and then the "Leliqs" (Letras de Liquidez). The Lebacs where a liquid and relative safe asset, created during 2002, when the central bank realized that it needed to implement an active monetary policy. The central bank issued the Lebacs to sterilize the purchase of foreign exchange to prevent the appreciation of the peso, which shortly after the collapse of the "Convertibility" reached a record high in real terms, helping the recovery during 2003-2008.

When Argentina adopted Inflation Targeting, the central bank issued more Lebacs and kept a very high nominal interest rate, but nevertheless had a hard time convincing the public that disinflation will happen fast and the peso was a relatively safe asset. According to the standard macroeconomic theory, Inflation Targeting works as a credible threat by the central bank, provided that monetary policy satisfies the Taylor Principle (Taylor, 1993), i.e., the nominal interest rate moves by more than inflation after a shock, so the real rate will increase to curtail excess demand for goods or decrease to combat excess supply for goods. The main take-home point is that when monetary policy is correctly implemented, inflation and output remain stable, and presumably disinflation can be achieved without output costs.

There are some critical conditions that should be satisfied for Inflation Targeting to work smoothly. Perhaps the most important one is "credibility". The Taylor Principle amounts to a threat by the central bank to increase the interest rate if inflation increases. The key is that central bank policies should be aggressive enough (i.e., the nominal rate should be increased or decreased by more than inflation) and credible10, so the public expect inflation to remain anchored.

Inflation Targeting was never tested during an episode of moderate or high inflation, and all the countries have adopted the regime when inflation was low or already falling, and certainly no country adopted a full-fledged Inflation Targeting regime with more than 10% inflation per year. If inflation falls at a slow speed and debt accumulates fast, the economy may easily get stuck into a debt trap scenario. Moreover, if inflation converges very slowly (or if it fails to converge), the very high and persistent nominal interest rates may become a risk to financial instability, and the public may suspect that the regime is not sustainable in the long run.

The canonical "New Keynesian model", which represents how Inflation Targeting is supposed to work, usually swept this kind of complications under the rug. The nice properties of the baseline model results may be affected and "sunspots" or instability are possible, and if the Taylor Principle is adopted in non-stable economy, the Taylor Rule will fail to anchor expectations and output and inflation will not be stabilized. In this case the threat to increase the interest rate amounts to destroying the real economy, so there is no anchor for inflation, as the public does not believe that the central bank will attempt such policy.11

In an open economy set-up, contractionary effects from depreciations, associated for example with the balance sheet effect (as in Céspedes et. al., 2004) or redistribution from wage income to profits and rents (Diaz-Alejandro, 1965) may imply that output and inflation are also not pinned down by a standard Taylor Rule (Libman, 2018). Indeed, with strong contractionary effects from depreciations, the sudden opening of the capital account may lead to a strong initial exchange rate appreciation, and some expansionary effects on the non-tradable sector may emerge. Moreover, opening the capital account usually leads to some expansion of credit, adding extra aggregate demand pressures.

While some of these effects may be welcomed, especially since the entire package included an abrupt adjustment of other key prices (such as transportation and tariffs), the expansionary effects may contradict the original purpose of the policy, which is to stabilize inflation, and in fact core inflation remained high during the period 2015-2017, and when it fell, it only did so very slowly. Thus, capital controls, macroprudential policies and intervention in the FX market may increase stability. Unfortunately, the government only intervened occasionally and without much conviction.

Sketching the Effects of inflation Targeting on Argentina

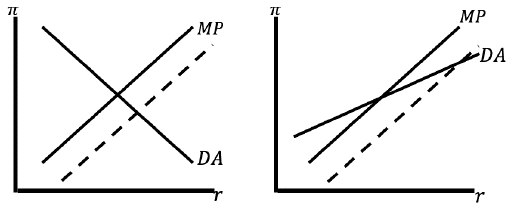

The ideas discussed on the previous section can be sketched and summarized by a small "model". Let us assume that non-tradable inflation is a function of expected inflation or trend inflation plus a term that depends on excess demand for non-tradable goods, or a term that measures wage growth, which in turns depends on employment that in Argentina is mainly located in the non-tradable sector:

Where the variables n, n e , Q and r denote "core inflation", expected (core) inflation, the real exchange rate, and the real interest rate. The в function captures the evolution of demand, and it depends on the real exchange rate and the real interest rate. As usual, we assume that higher real rates cut demand, reducing inflationary pressures. The real exchange rate, which is the relative price of tradable to non-tradable goods, may increase or decrease non-tradable inflation, depending on how it affects expectations and demand. Moreover, it is a decreasing function of the real interest rate and a positive function of the risk premium, for instance, if we model it assuming that the UIP holds and the economy is on the saddle-path.

The real interest rate is an increasing function of the inflation gap (the deviation of inflation from the target) and an increasing function of the risk premium, if under situations of extreme duress, the authorities are forced to increase the real rate, even if this contradicts the logic of inflation targeting. More precisely, let us say:

Where RP and ϖ T denote the risk premium and the inflation target. The term p is a positive parameter. Equation (2) is a special Taylor-Rule. It is similar to the popular specifications because higher real rates are implemented whenever ϖ> ϖ T , and lower rates when ϖ < ϖ T . However, the authorities also take into account the risk-premium that prevails in international markets for emerging economies. When there are pressures on emerging markets, the local authorities may respond with an increase in the domestic real rate (or with other tools, such as strategic interventions in the FX market).

Thus, the authorities set the real rate following a Taylor-Rule when there is no stress in foreign exchange markets 0=0, but they resort to extreme measures when 0=1 (i.e., they abandon Inflation Targeting). We can loosely interpret this as the ex-ante situation where the central bank follows a generalized rule, weighting each objective according to its perception. In practical terms this equation may not be compatible with Inflation Targeting, but since we are exploring the case of Argentina this is not an important issue.

Combining both equations, we obtain a system that can be solved simultaneously. If the real exchange rate is a negative function of the real interest rate (given other factors), then an increase in the real rate will affect demand directly and indirectly via its effects on relative prices. In Argentina exchange rate depreciations can be contractionary, so a higher Q may cut demand. Conversely, a lower Q may expand non-tradable demand, so non-tradable inflation may fall very little. Thus, a very tight monetary policy, for instance one adopted after the announcement of a very ambitious inflation target (i.e., one that implies a large reduction in inflation), may create opposite effects on demand: a higher real rate may reduce demand, employment, wage growth and inflation, but it can also have expansionary effects due to the resulting real appreciation.

Consider now a reduction in the risk premium (i.e., an increase in the capital inflows after December of 2015). The real interest rate and both the nominal and the real exchange rate fall. We can see that this is the case since O<0<1, so the real rate falls by less than the risk premium. Additionally, the implementation of Inflation Targeting implied an initial increase in the real interest rate that the central bank deemed appropriate given the extremely ambitious goal of achieving low inflation in a matter of a few years. Hence, demand expands and non-tradable inflation will increase, unless expected inflation falls enough. It is important to stress that a very open capital account with low credibility complicated the battle against inflation. Total inflation may fall a little bit if nominal appreciation cheapens imported goods, but non-tradable inflation (which we can identify with "core" inflation) will probably not, at least in the short run. Adding the increase in public sector tariffs only made the inflationary problem worse.

A similar combination was experienced during the so-called "Tablita" (a preannounced rate of depreciation below the prevailing rate of inflation), adopted in the late 1970s as a stabilization policy. The "Tablita" appreciated the real exchange rate with little effect on inflation (Calvo, 1983). Perhaps the only positive side effect associated with real appreciation is that it has contributed to sustain demand, but this effect was probably not enough to compensate for the contraction of incomes associated with the sharp increase in the price of gas, electricity, and transportation.

The operation of the toy model is shown in Figure 2, where the DA curve represents equation (1) and the MP curve represents equation (2). We show the case where depreciations are expansionary or weakly contractionary (left), and the case where depreciation are strongly contractionary (right). Consider a more contractionary monetary policy, for example if the central bank announces a reduction of the inflation target. In the traditional case (i.e., expansionary depreciations), the real exchange rate appreciations, and combined with the increase in the real rate, this brings a reduction of inflation. When depreciations are contractionary, if the effects of the real appreciation are more important than the increase in the real rate, inflation actually increases after the contractionary policy.12

This toy model illustrates that tapping international capital markets to reduce inflation may fail. When depreciations are contractionary, a tight monetary policy may expand demand, with little (and even unfavorable) effects: inflation may even increase.13

We explored the effects of tight monetary policy, but an increase in aggregate demand triggered by capital flows (which may lead to a shift of the DA curve to the right) will have similar implications: inflation will accelerate. Thus, opening the capital account without a credible anchor for expectation may easily accelerate inflation.

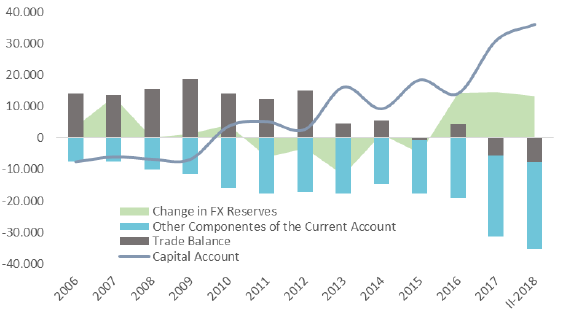

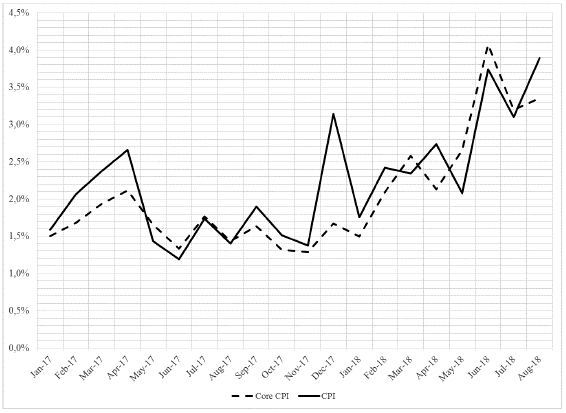

Figure 3 illustrates the dynamics of CPI and Core CPI inflation during 2017 and the first eight months of 2018. In Argentina Core CPI excludes goods whose prices are heavily regulated or include a lot of taxes (such as transportation, cigars, gas, electricity and water) and goods affected by seasonal patterns (for instance fruits, vegetables, tourism or clothes); it accounts for about 70% of the CPI basket.

Source: own elaboration based on "Estadísticas y Censos" from the Autonomous City of Buenos Aires. *Includes only January-October.

Figure 3 CPI by Components (Autonomous City of Buenos Aires)

As we can see, inflation only decreased very slowly during 2017, even if we exclude goods with excessive volatile components and elements that do not depend on market conditions. It did fall significantly when compared to 2016, but this includes the effects of the large exchange rate depreciation after the removal of the controls. When compared to 2015 it was less than one percentage point below. Moreover, it accelerated again in 2018 due to the sudden-stop and the new depreciation of the peso.

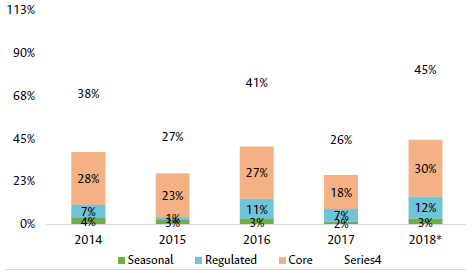

Consider now the evidence presented in Figure 4. There was a slight decline after the first three months of 2017, but inflation never fell below 1.2% - 1.5%, which implied an annual rate of about 26% - 30% and was inconsistent with an original target of 12 - 17%. The small but noticeable recovery of the economy during 2017 combined with the adjustment of relative prices (excluding the exchange rate, which helped to expand the domestic market) and a sluggish adjustment of expected inflation are the main culprits. This seems consistent with the situation depicted in the right of Figure 2.

Source: own elaboration based on INDEC (The National Bureau of Statistics and Censuses from Argentina).

Figure 4 Core CPI and CPI Inflation (monthly rates)

The events at the end of 2017 and the first part of 2018 which implied an increase in the risk premium, led to a sharp real depreciation. Why did inflation increase? The contraction of demand associated with the increase in the risk premium was not enough to reduce inflation, as inflationary expectations were adjusted upwards. Our simple set-up can also capture this, for instance, by an increase in Ø, which may weaken the credibility of Inflation Targeting. Indeed, there were signs of increasing inflation after a public conference in December 2017. Although some believe that this specific episode is largely responsible for the complications that followed, it may seem possible to argue that there was some effect on inflationary dynamics, as the perception was that the central bank was no longer committed to keeping inflation in check.

It may be pointed out that due to the lack of credibility, this argument gives too much weight to expectations and the perception by the public. After all, the central bank was missing the target consistently, so who cares if the target is increased. But we believe the point is incorrect, because it misses the fact that the official target may have some weight on expected inflation. Thus, if we let expected inflation be a weighted average of the official target and the public perception or even the actual trend of inflation (ϖ), we have:

Notice that "perfect credibility" boils down to σ=1 (because then ϖ e =ϖ T ), while "perfect incredibility" means σ =0 (then ϖ e =ϖ). If the truth lies somewhere in the middle, and thus for any σ >0, an increase in the target w ill lead to an increase in expected inflation.

To summarize, as the Argentinean case shows, a policy of targeting the domestic interest rate in the context of a fully open capital account with a flexible exchange rate regime, may fail to anchor expectations and may induce capital inflows, leading to strong pressures towards real exchange rate appreciation, with little effects on inflation. Not only may the central bank credibility be undermined, but also the external imbalances may lead to an accumulation of external indebtedness and the domestic economy become too exposed to a sudden-stop.

A note on the 2018-2019 IMF Program

The original SBA granted to Argentina was approved in June 2018 for an outstanding amount of US$50 billion (SDRs 35.379 billion), which is equivalent to about 1110 percent of Argentina's quota at the IMF and represented the largest loan granted by the Fund to a single country in its history. The SBA was supposed to have a three-year duration and its disbursement was conditional on the fulfillment of a number of targets related to the evolution of fiscal accounts and monetary policy. Specifically, the program was based on the premise that contractionary fiscal and monetary policies will restore confidence, and by catalyzing private capital flows, Argentina will regain market access. However, this is inconsistent with the research on the catalytic effect of IMF programs that can also work in the opposite direction, convincing markets that default is more likely as the IMF gets repaid first (Cottarelli & Giannini, 2002).

The Program had only four reviews (of twelve expected). The initial disbursement amounted US$15 billion. Half was earmarked for budget support, and the remaining half to strengthen the Central Bank's foreign exchange reserve position, with the expectation that this would reduce pressures on the capital account. Instead, the Program failed to restore "confidence" and it was revised. After the first review of the program in October 2018, the authorities were allowed to draw the equivalent of about US$5.7 billion. The IMF also approved an augmentation of the SBA to increase access to US$56.3 billion (about 1277 percent of Argentina's quota).

In December 2018, the second review was completed and allowed the authorities to draw the equivalent of an additional US$7.6 billion, bringing total purchases since June to about US$28.09 billion. Furthermore, the government officially abandoned Inflation Targeting and replaced it with an interest rate rule for monetary targeting (with a target for zero monetary growth). A (presumable) fully flexible exchange rate was replaced by a wide band, which started between 34 and 44 pesos per dollar and would be adjusted upwards by 3% per month, and a policy of zero primary fiscal deficit for 2019 was promised.

In April 2019, the Fund completed the third review, and Argentina's government was able to draw the equivalent of US$10.8 billion, bringing total disbursements since June 2018 to about US$38.9 billion. One month before, during March 2019, the IMF authorized the Central Bank of Argentina to sell up to US$ 9.6 billion of foreign-exchange reserves to support the exchange rate. Between March and May 2019, the authorities introduced a freeze of utility tariffs for the remainder of 2019 and measures to contain price increases for mass consumption goods.

The fourth and final review was completed in July 2019, prior to Argentina's primary presidential elections. At that time, and even in a context in which the economic crisis was clearly worsening in Argentina, the country passed the review. During the last part of 2019, the exchange rate increased even more, towards 63-65 pesos per dollar, as the government lost the presidential elections of October. Capital flight accelerated and the capital controls were re-adopted right after the political defeat, and the gap between the official and the black-market rate widened. Figure 5 shows the evolution of the official and black-market exchange rates.

Source: own elaboration based on Central Bank and Ambito Financiero.

Figure 5 Official and Black Market Exchange Rates

Political uncertainty intensified the pressures on the foreign exchange market, as it became clear that the Administration in power would lose the general elections (which took place in October). The authorities then were left with almost no other option than to reintroduce capital controls, requiring producers to surrender export proceeds, and monthly purchases of foreign exchange for non-commercial purposes were restricted to US$ 10,000 per person, which were later reduced even further to US$ 200. The review that should have taken place during July did not take place and the program was eventually canceled (during July of 2020), so out of a total of 57 billon US dollars, 44 billion US dollars were effectively disbursed.

In a nutshell, the program was revised and the policies were recalibrated several times, but in all its incarnation it failed to deliver. Confidence was not restored, inflation accelerated, and output contracted, despite the fact that the central bank sacrificed about US$ 29.000 million between April and December of 2019.

Conclusions

What are the lessons from Argentina's recent swing from financial repression to financial liberalization and an IMF bailout? The key message of this paper is that capital controls combined with incorrect macroeconomic policies are very problematic, but the solution is not necessarily a fast and full-blown capital account liberalization. While the latter is incompatible with a stable macroeconomic environment, the former can easily create an unsustainable path for public external debt. Finally, resorting to the IMF is not the solution: if the underlying problems are misdiagnosed, resorting to traditional contractionary fiscal and monetary policies will not restore confidence.

Our main argument is based on the hypothesis that several features of the Argentinean case were systematically ignored. For example, the presence of contractionary effects from depreciations and the expansionary effects of capital inflows and the presence of some informal indexation of some contracts, the extremely attractive returns offered by Argentina triggered a process where short-term flows and the external indebtedness of the government led a sharp real exchange rate appreciation, with little effects on inflation. The adjustment of regulated prices created additional inflationary pressures.

As the crisis unfolded, the policies were revised and the IMF joined the party. But traditional contractionary fiscal and monetary policies will be of little help, given the abovementioned characteristics of Argentina's recent macroeconomic environment. It is thus not surprising that the largest loan in the history of the multilateral financial organization benefited those who buy foreign exchange at convenient exchange rates, as confidence was not restored, and the capital account remained open.

To summarize, the December 2015 program and the IMF loan reinforced the problems that it intended to solve, and perhaps the only "positive" aspect is that some adjustment of key relative prices was achieved, but at the cost of higher indebtedness and a very poor record in terms of inflation and the growth of per capita GDP.