Introduction

During the 1990s, especially following the establishment of Convertibility of the Argentine peso to the US dollar in 1991, the implementation of International Monetary Fund (IMF) adjustment measures deepened the commercial and financial dependence of Argentina's economy. In the heat of transformations that occurred after the 2001 crisis, a debate arose on the scope of those changes and on the implementation (or non-implementation) of a different economic model in Argentina. Comparative analysis of external insertion in the periods 1991-2001 and 2002-2015 is fundamental to the context of this debate.

In the present work, we intend to verify whether these changes to economic policy and the financial "disconnection" resulting from the crisis have altered Argentina's external insertion or maintained its dependent character (signaling continuity with the pre-crisis period). To do this, we employ a broad understanding of the notion of external insertion that encompasses both its commercial and financial aspects.

To begin with, we define the characteristics of commercial insertion and financial dependence by way of a theoretical review of both concepts as well as the links between them. Next, the economic policy measures implemented from 1991 to 2015 are described, in order to distinguish elements of change and continuity. Once this contextualization is complete, our analysis of the commercial aspect focuses on competitiveness. In this vein, a predominance of low wages versus productivity improvements as a guiding factor in Argentine commercial competitiveness would point to a continuity of dependent commercial insertion, reinforcing the significance of branches with low added value in exports, and of technology dependence in imports.

Regarding the financial aspect of foreign insertion, the payment of foreign debt, capital flight, and the workings of exchange rate policy are the main mechanisms on which our study focuses in order to contrast rupture and continuity in dependent financial insertion. These three mechanisms formed part of the external financing needs of Argentina's economy throughout the entire period, ultimately serving to maintain dependent financial insertion.

Trade, finance, and dependency

In order to test whether the external insertion of the Argentine economy has remained dependent, it is necessary to delimit the concept of dependent external insertion and to establish its characteristics, in both commercial and financial terms. Following a critical review of the literature on this subject, we lay the theoretical basis for an analytical proposal in order to study external insertion in its commercial and financial aspects, as well as their mutual interdependencies.

Commercial competitiveness and dependence

The notion of commercial dependence (or dependent commercial insertion) as we employ it here refers to a situation wherein the type of subordinate external insertion of a given economy causes its foreign trade to depend on elements that are outside that economy's control. In this sense, the notion is indebted to approaches from Dependency theory; however, it does not share causal explanations provided by other approaches from the Dependency school that locate the origin of such commercial insertion in the existence of monopolies, international transfers of profits, etc.

As relates to the origin of a situation of commercial dependence, and to explanation of the causes and consequences of same, in this work we follow the postulates of the so-called classic Marxian1 approach whose chief exponent is Anwar Shaikh, along with economists E. Tonak, G. Duménil, D. Lévy, K. Uno, S. Cullenberg, A. Valle, D. Guerrero, and M. Román, among others (Guerrero, 1997, pp. 181-197)2. Following this approach, an underdeveloped country must sustain its exports on either low wages or an abundance of natural resources. Especially in the case of trade deficits, these factors will attract powerful foreign capital that will help control wages, which will reinforce the adoption of labor-intensive techniques (Shaikh, in Guerrero, 2002, p. 282). There is a causal relationship between the ability of firms in an economy to compete in the world economy (whether this is understood as the capacity to offer at given prices an expansion of the profit margin, or the ability to obtain greater profits at given prices) and the trending balance of those elements in the economy's balance of payments.

In this research, an absolute advantage approach is assumed. Thus, it is the ability of firms or countries to produce with lower costs than their competitors what will explain their competitiveness. Accordingly, the capacity of a company (or an aggregate branch of activity) to compete in international markets is determined by the following elements:

The relative evolution of the general consumer price index (CPI) of the economy in relation to the prices of tradable goods (or prices of the sector, in sectorial comparisons) (pc / pct)3: the lower this quotient - vis-à-vis the country of comparison - the greater the absolute advantage, if that relationship remains constant in the country with which the comparison is established.

The real wages of the country's tradable productive branches (wr): the lower these are in relation to the other country, the greater the absolute advantage.

The nominal exchange rate (e), expressed in amounts of foreign currency for one unit of national currency: the smaller this is, the greater the absolute advantage over the country of comparison.

The vertically integrated labor coefficients (АД which give a measure of productivity by way of its inverse: the lower the relative coefficient of the country of comparison, the greater the absolute advantage over that country. This coefficient gives a measure of the amount of labor that has been needed from all the branches of the economy to produce a unit of output.

Vertically integrated profit rates (q), which permit the measure of firms' profit margins on costs, in order to set prices: the lower the relative price of the country of comparison, the greater the absolute advantage.

But our objective here is neither to comparatively quantify4 the elements of Argentine commercial competitiveness, nor to quantify the relationship between those elements and trade balances, but rather to establish the causal links between the evolution of the aforementioned factors in the Argentine economy and the persistence (or not) of dependent commercial insertion. Further, we seek evidence of mutual causality in terms of financial vulnerability and dependence, and the possible role of the anti-wage policies in that dynamic. According to the scheme presented, ways to improve the international competitive position of a particular sector in a country (by increasing its advantage or reducing its absolute disadvantage) will include:

Containing the evolution of prices for the sector in question in relation to general price levels. This can be induced, for example, through a reduction of tariffs combined with the reduction of wages known as internal devaluation (De Grauwe, 2012; Paúl & Uxó, 2014).

Reducing real wages. This measure is known as wage devaluation (Estrada et al., 2013; Paúl & Uxó, 2014; Pérez-Infante, 2013; Uxó et al, 2014).

Reducing the nominal exchange rate. This measure is known as nominal or monetary devaluation.

Raising labor productivity. The usual way to accomplish this is by inducing technological change.5

Reducing the profit margin on the cost per unit of product, so that sales prices decrease.6

The more predominant aspect among those listed above will determine the type of commercial specialization in the country: an economy that bases its competitiveness mainly on low wages will specialize in products with low added value, while one basing its competitiveness on sustained increases in productivity will tend to specialize in products with higher added value.

At the same time, the financial implications of these options are different. Especially in the manufacturing sector, branches featuring lower added value generally have less intensive in physical capital and have lower financing needs than branches that add more value. However, the fact that a branch may generate less value added also makes it more difficult to finance. In the case of natural-resource intensive sectors, we must add the historical experience of relatively unstable price evolution. The consequence of all this is a preference for liquidity of investments, which penalizes the financing of innovation processes that can entail a progressive increase of labor productivity and progressive changes in the pattern of commercial specialization.

Underdevelopment and financial dependence

In establishing our definition of dependent financial insertion, we begin with contributions made to describe the process of financialization in underdeveloped countries, also incorporating those authors who have specifically described international financial insertion in Latin America, from the most current approaches to Dependency.

From the first set of contributions, Salama (2006) analyzes financial dependence that generates external debt; when resources from exports are reduced, attraction of capital through the indebtedness of the State becomes significant. The integration of the Latin American economies into the international financial system in the seventies has taken place through two stages: first, the nationalization of private debt, once the flow of capital toward international indebtedness has begun; and second, adherence to the Washington Consensus, which favors financial liberalization and deregulation.

Throughout the years 2000, in a context of reduction of external debts, the mechanisms of financial dependence change. Lapavitsas (2013) explains what happened in "developing" economies in the early 2000s, when capital was received via trade balances, high commodity prices, and Foreign direct investment (FDI) - on the one hand- while debt flows turned negative (on the other). The "subordination" in such a case is explained by the accumulation of reserves as an international means of payment and to avoid the appreciation of currencies, which was driven by the opening of the capital account.

As for the second group, Carcanholo (2004) explains that underdeveloped economies have a strong dependence on foreign capital, with high financial fragility and low resistance to oscillations in the international market; that is, they are characterized by a high external vulnerability. International financial dependence is justified by the greater vulnerability of international commodity prices to changes, in the global political and economic spheres, as compared to higher value-added manufactured products, whose impact on external accounts generates a reversal of the liquidity cycle (dos Santos, 2012).

To this are added certain historical structural conditions present in these countries. Remittances in the form of interest, profits, redemptions, dividends, and royalties, as a result of the importation of capital and the instability of international financial markets, usually result in high interest rates for the provision of credit by placing peripheral dependent countries at the mercy of the international liquidity cycle (Carcanholo & Nakatani, 2006).

Aguiar (2011), in turn, argues that the development models of Latin American countries include financial integration into the world economy characterized by external indebtedness. This indebtedness is explained by historically chronic trade imbalances due to trade specialization and the volatility of primary export prices, as well as to the existence of financial cycles. Latin American economies move through financial cycles characterized by an influx of liquidity from developed countries resulting from financial innovations and changes in interest rates. This excess supply of foreign currency could generate a deficit in the current account (rise in imports and/or fall in exports) via appreciation of the domestic currency rate.

These cycles end with a reversal in the terms of trade, an interest rate reversal and capital flight, all leading to strong restorative devaluations of the real exchange rate at lower levels. The result is an exchange rate that is vulnerable and depreciating. Thus, this type of financial integration (through significant vulnerability of real exchange rates) impacts on trade, putting the diversification of exports at danger and simultaneously generating a propensity by the "cosmopolitan" domestic classes7 to interfere in economic policy and to preserve assets denominated in a foreign currency (Aguiar, 2011). This high financial dependence affects the performance of exports in the long term and, consequently, the development of economies, "financial dependence is simultaneously a cause and a consequence of this commercial insertion in the world economy" (Aguiar, 2011, p. 5).

In the Argentine case, this behaviour goes beyond the elites. Since the financial liberalization implemented in the 1976 military dictatorship and the continuous inflationary crises that have occurred before and after it, the whole society buys dollars to save (Bercovich & Rebossio, 2013; Gaggero & Nemina, 2016). This phenomenon affects the dollar demand and can have a destabilizing impact on the exchange rate, deepening the need for foreign exchange in the economy. This is one of the reasons that explain why the American currency has become one of the preferred financial assets for financial speculators.

From these collected contributions we extract our definition of financial dependence. This condition would be associated with the need of economies for external financing linked to two elements that heighten their vulnerability to external liquidity cycles: the tendency toward deficit of the current account, as a result of commercial and productive specialization; and elevated volumes of capital outflows linked to financial factors such as the payment of foreign debt, capital flight, the payment of dividends and speculation around the dollar8.

The financial dependence is mediated by the external debt of underdeveloped countries, as a result of their structural problems in which external insertion plays a fundamental role. That is the central idea from the theoretical contributions presented in this section. The Latin American economies were integrated into the global financial system through this debt. The debt conditions their commercial insertion, at the same time, due to the international trade and the debt itself provides the resources for the payment of the external obligations. Here it founds the reason why the financial dependence limits the possibilities of diversification of the foreign trade.

Historical contextualization: Argentine economic policy in perspective

The objective of this section is not to exhaustively describe the specific economy in which the economic events under study take place. These are overlapping processes that occur within a complex context, always in relation to other processes and events. Nevertheless, we understand that an adequate contextualization is needed to describe the main decisions taken in the field of economic policy, as these influence the concrete ways in which the economic processes that concern the present research are revealed. In fact, the two sub-periods into which Argentina's recent economic performance are usually divided are delimited by the application of a policy of utmost importance: the fixing of the peso-to-dollar exchange rate, also known as Convertibility.

The Convertibility period: 1991-2001

In the 1990s, and under the presidency of Carlos Saul Menem, major changes took place in Argentina's economy and society. Although the neoliberal turns in Argentine economic policy dates from the earlier Civil-Military Dictatorship (1976-1983), in the period from 1989 to 2001, these policies reached their maximum expression. This is largely explained by the role played by the IMF throughout the period under review, as a mediator with external creditors and as a creditor itself, exerting considerable influence on the content of economic policies through conditionality clauses (to which agreements signed by Argentina's government were subject).9

Following the economic and social commotion caused by the hyperinflation of 1989, the prime objective of the new government became the control of prices. Two initial unsuccessful attempts were made to effect this, accompanied by deep structural reforms including Law 23,696 for State Reform (LRE) and Law 23,697 for Economic Emergency (LEE), along with the advent of privatizations.

The third and definitive attempt to stabilize prices was named Plan of Convertibility (Law 23,928). Upon this were based the exchange rate and monetary policies, in two fundamental pillars:

Fixed parity of the Argentine peso to the US dollar with legal recognition of bimonetarism (contracts and payments could now be made in dollars).

Commitment by the Central Bank of Argentina (BCRA) to back 100% of the monetary base with assets in foreign currency, making it impossible to issue a single peso without a counterpart in foreign currency or gold.

This configuration denied the BCRA the possibility to implement active monetary policy (Gambina, in Sader, 2001, p. 195). The result was a highly pro-cyclical financial system, which made it difficult to generate credit during crises and made the overall economy more vulnerable. The new monetary regime was completed in 1992 with reform of the BCRA, which became independent from the executive branch and very limited in its ability to buy public debt. The success of this monetary regime in controlling prices provided a wherewithal to deepening structural reforms that would reduce public spending and favor the influx of foreign currency. Measures such as lowering tariffs or the initial setting of a high peso-dollar parity were also undertaken, in contradiction to the goal of reducing imbalances.

Structural reforms undertaken in Argentina stand out because of their depth: in a concentrated period of 5 to 8 years, the program managed to privatize the vast majority of state-owned companies, to eliminate legal controls on markets that had once been public monopolies (often resulting in the creation of private monopolies that raised prices and tariffs), to open the economy without restrictions to capital or commodity flows, and to take significant steps toward labor deregulation and the privatization of pensions.

At the same time that privatizations and administration reform were being instituted, price deregulation was undertaken, along with regressive tax reform, the dismantling of the industrial-promotion regime, and trade liberalization (carried out abruptly, as a shock measure to combat inflation, then reaffirmed in the framework of efforts to move Mercosur forward).

Meanwhile, beginning with implementation of the LEE (1989) and LIE (Law on Foreign Investment, 1993), the total liberalization of foreign investment was enabled, thus facilitating the drainage of resources abroad. Likewise, important financial institutions were privatized, including Banco Hipotecario Nacional and the National Savings and Insurance Fund (the largest Argentine insurer). Moreover, the National Development Bank was dismantled (Gambina, in Sader, 2001, p.200).

Financial reforms led to a progressively concentrated system with a growing participation of foreign capital: if 60% of assets were publicly owned in December 1991, by May 1999 that percentage had fallen to 30%, while in the same time the share of foreign capital rose from 14% to 51% (Raffin, 1999, p. 7).

In line with these financial reforms, and with labor reforms undertaken throughout the decade, the partial and progressive privatization of pensions was carried out. This involved the gradual extinction of the pay-as-you-go system and its replacement by a system of capitalization composed by independent private financial institutions (Retirement and Pension Fund Administrators, or AFJPs). This was coupled with raising the retirement age. As a result of these reforms, a system was set up with a growing predominance of capitalization10 (to reach 80% in 2004), increasingly concentrated and with a poor quality asset portfolio11. Pension reform had an increasingly negative impact on public accounts (contributions to the public pension system declining much faster than pension benefits), but it heralded substantial business opportunities for the financial sector.

The implementation of these adjustment policies eventually triggered the final crisis of Convertibility, which led to abandonment of the exchange rate regime: the high peso-dollar parity implied by Convertibility, coupled with trade liberalization, caused a trade and structural deficit in the balance of services, while the fiscal deficit rose prompting public debt into an unsustainable path. At the same time, the financial sector was increasingly dollarized (with liabilities in dollars growing faster than assets), unstable (thus, increasingly exposed to external shocks), concentrated, and foreignized. Since foreign direct investment proved insufficient to close the trade gap, short-term speculative capital was sought to complete the financing. Thus, the balance of payments was exposed to severe fluctuations, presenting a lower surplus as the decade progressed. This led also to shrinking net inflows of foreign currencies, which the mechanism of Convertibility had made indispensable to finance the expansion of the monetary supply.

On the other hand, the increase in external indebtedness was greater than the rise in exports, and this further impaired the ability to pay. All these mechanisms placed increasing pressure on Convertibility - and forced an increase in efforts to defend it.

The Post-convertibility period: 2002-2015

Between 2000 and 2001, the financial and economic indicators were very deteriorated, and the country's risk rose. After several attempts to save Convertibility, which only aggravated the situation, the high leakage of bank deposits and the fall in reserves ended with implementation of the "financial corralito" as a last attempt to preserve Convertibility and avoid the suspension of payments. According to the final report of the Special Commission of the Chamber of Deputies in 2001, $29.9 billion left the economy that year (13% more than this year's total exports), using the financial system as a channel for escape (Comisión Especial Investigadora de la cámara de los Diputados, 2001).

The restriction on free access to fixed-term cash, checking accounts, and savings banks known as the "corralito" became the catalyst for social outbreak on the 19th and 20th of December 2001, that ended in the fall of the government. The social situation was devastating12 and the macro-economic model was unsustainable, with a trade deficit of 1.2% of GDP, a public deficit of 3.9%, no possibility of access to international financing, and interruption of payments and collections.

On December 22, 2001, Adolfo Rodriguez Saá (during his brief term of only 7 days as interim president) declared the partial suspension of payment of the public debt (default); in January 2002, Eduardo Duhalde declared the end of the Convertibility Law.

From then on commenced a period characterized by greater intervention by the State and the implementation of non-neoliberal measures. However, the lack of depth of these changes meant that the economy would maintain its structural characteristics.

Despite dire expectations generated by the depth of a crisis that affected the economic, political, and social spheres alike, the Argentine economy began to show signs of recovery as early as the second half of 2002. The initial devaluation led to a drop in imports, a fall in labor costs, and an increase in public debt (due to the high composition of foreign currency instruments). Likewise, some substitution of imports was regained. This occurred in a context of international trade favorable to the country's exportable products, making possible some improvements to public accounts through taxes on exports (which increased throughout the period) and the accumulation of reserves by the Central Bank - indispensable for continuity of the monetary and exchange rate policies of the period. This was the beginning of the long commodities boom and that it affects the soy growing areas of the pampas. Policy was here characterized by control of the exchange rate peg, to avoid its appreciation in early post-crisis years and its later devaluation. The negative effects of the devaluation on the financial sector were offset by the bailout of the sector.

Another measure taken in the context of recovery was the obligation to settle foreign exchange receipts from exports in the foreign exchange market. Possible inflationary effects of excess currency were avoided through the sterilization policy of the Central Bank. The liquidation of currencies increased the liquidity of the economy, so the Central Bank issued bonds to absorb it with the purpose to avoid the inflationary effects.

During the government of Nestor Kirchner (2003-2007), the Argentine economy grew at an average rate of 9%, and stability of the main macroeconomic variables was achieved, obtaining surpluses in the current and public accounts (the so-called twin surpluses) (CENDA, 2010). This high growth was due to the combination of the improvement in the prices of commodities that allowed the flow of resources for the State and for the payment of the debt, and the economic policy measures that allowed some redistribution of income, boosting the demand, especially through consumption.13

Throughout this period, a new approach to public debt management was initiated involving the restructuring of debt in default in 2005, and the payment of obligations to the IMF in 2006 ($9.53 billion). This restructuring took place between light and shadow - although unaudited, illegitimate debt14 and its mechanisms maintained profitability for external creditors, payment became sustainable, and negotiations were achieved without the intervention of the IMF, thus avoiding further conditioning.

However, the first signs of the end of this boom period began when, in 2007, inflation broke out on the economic scene and the problem of capital flight again resurfaced.

In 2008, conflict with producers of agricultural exports over implementation of a new model of taxes on exports culminated with abandonment of the reform, and this was interpreted as a clear sign of limits to maneuver for the government of Cristina Fernández (2007-2015). The reform sought a greater flow of resources from the commodities boom to the state. Not only they were used to social distribution but also to pay the debt services.

In 2009 the fiscal deficit reappeared, and in 2010 the current account turned negative for the impact of the international crisis and the payment of public debt. Also, the primary public spending began to grow after the international financial crisis, and it became negative since 2011. 15

That year also saw the reopening of a public debt exchange for those creditors who had refused to join in 2005, as a result of increasing pressures from the so-called "vulture funds". The exchange was successful, but it failed to dismantle the conflict with these funds, which by the end of the period would jeopardize the sustainability of the 2004 restructuring.

At the same time, the external accounts were pressured by imports of capital goods (Manzanelli & Schorr, 2013). The energy deficit began to be a problem since 2008 when international commodity prices stopped growing16.

Measures such as controls on the foreign currency market by the Central Bank in 2011 and reform of the Central Bank's Organic Charter in 2012 attempted to preserve the exchange control model (competitiveness) and to guarantee the payment of restructured debt. Control over access to currencies was instrumented through authorizations of the Central Bank, and through limited access to foreign currency to send dividends abroad, or for personal hoarding. At the same time, the new Organic Charter of the Central Bank extended financing margins to the Treasury and eliminated certain obstacles to the use of reserves for the payment of external debt.

While some control over capital flight was achieved with the first measure, thus safeguarding international reserves that allowed for exchange control and debt repayment, the black market of dollars was activated17. The "blue" market for dollars increased pressures on exchange rate parity, and although attempts were made to keep this influence in check via capital market law (as a way of attracting investors and savers accustomed to taking refuge in the dollar), devaluation of the peso at the beginning of 2014 could not be avoided. There was an increase in external public debt which, although incipient, had begun to show signs of recovery in 2013.

The period from 2002 to 2015 was a time of social recovery - though it would be impossible to recover everything lost since the first application of neoliberal measures in the mid-1970s. Unemployment was reduced to rates of around 7%, and some novel social measures were taken, including aid to families suffering exclusion.

This period drew to a close in December 2015 amid discontent and the political polarization of society.

Analysis of Argentina's commercial insertion

In order to approach the study of Argentina's commercial insertion and its evolution through the period under study, we will first consider the available statistical evidence in relation to the sectorial and technological composition of Argentine exports, as well as the evolution of imports by economic use. Next, based on the theoretical guidelines described above, the indicators of the various elements of Argentina's commercial competitiveness (constructed for the present investigation) will be exposed, allowing us to draw conclusions in terms of factors that explain the trends observed in Argentine trade statistics.

If we consider the entire period under study, only 30% of exports of Argentine goods correspond to manufactures of industrial origin, according to data provided by the National Institute of Statistics and Census (INDEC). This percentage has risen only very modestly in an economy that has meanwhile tripled its per capita income,18 indicating the extent to which the agro-energy export structure has been maintained.

At the same time, exports of goods with high technological content were less dynamic in Argentina than in other "emerging countries", especially in the 1990s. According to data provided by the World Bank, exports of technological products accounted for 7.95% of total exports of manufactured goods in 1992 (higher than China or Brazil at that time), a variable that remained almost steady throughout the whole period. The figure for 2015 was 9.00%, whereas Brazilians technological exports accounted for 12.31% of its total manufacture exports, and the Chinese ones represented as much as 25.75%.

This fact has been coupled with a progressive increase in the commercial dependency of capital goods. According to data provided by the INDEC, from 1991 to 2015, total Argentinian imports multiplied by 7.22. But imports of intermediate and consumer goods grew below that average, whereas those of capital goods, parts and accessories for capital goods and even motor vehicles grew above the average.

As mentioned above, there exist causal relationships between the elements of Argentina's commercial competitiveness and the long-term results of foreign trade as experienced in terms of specialization tendencies. A quantitative approximation is thus established for these elements, allowing us to compare their evolution over time.19

The process of constructing the aforementioned battery of indicators is described below, with a view to performing analysis based on quantitative information. To this purpose, it has been necessary to thoroughly develop and estimate data to allow for maximum use of the available information20:

Homogenization of the available input-output tables (IOTs) so they are consistent with the classifications in two productive branches. For this purpose, aggregation matrices were made consistent with the decision to classify and aggregate branches into two broad sectors (tradables and non-tradables).21 IOTs from 1973, 1997, and 2004 were taken into account. For 1991 to 1996, technical coefficients were estimated via linear interpolation, while for years after 2004 the same technical coefficients of this year were applied.

Obtaining vertically integrated unit employment requirements (A.) for the two large branches combined (expressed in jobs per monetary unit - million US Dollar - of total product). This required the estimation of total outputs from final demand and the Leontief inverse. Combining these with employment statistics by branch, the direct employment coefficients (L), multiplied by the Leontief inverse, calculate A.

Obtaining the real wages for each aggregate of branches.

Obtaining the vertically integrated benefit coefficients (q) for the two large aggregate branches. For this purpose, the direct benefit coefficients (r) in the case of Argentina were estimated through calculation of the salaries of branch-to-branch employees (estimated, in turn, based on data for value added, employment, and wages). The values thus estimated have been proportionally corrected by the value of the share of wages in GDP. The vector of direct benefit coefficients has been multiplied by the Leontief inverse, resulting in q..

Calculation of the price indices of each aggregate of branches in relation to the general CPI.

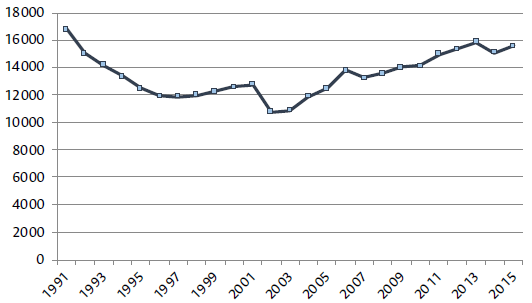

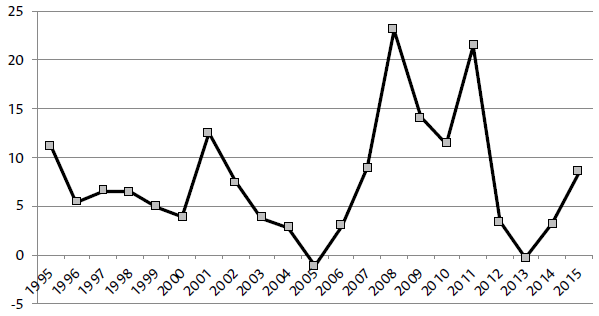

Figure 1 shows the real wages of the tradable sector in Argentina, calculated as the average of the wages of the pertinent productive branches weighted by their respective weights in the total population employed in the formal sector. A gradual decline occurred from 1991 to 1997. During this period, real wages in the tradable sector fell by about 30%, from $16,753 to $11,836 (1993 constant dollars).22 During the economic and financial crisis that led to the abandonment of Convertibility, wages rose slowly, to $12,726 in 2001, again falling to $10,760 the following year (coinciding with abandonment of the exchange rate anchor to the dollar). Thereafter, the average annual salary in the tradable sector began an upward trajectory that peaked in 2013 (at $15,796), after which it stagnated, below levels of 25 years prior. Throughout the period, wage levels remained well below those of the United States23, considered a paradigm developed country for its income levels and the structure of its foreign trade (also the second trading partner for Argentina, and whose currency was anchored the peso between 1991 and 2001, which made a balanced trade with that country an essential requirement for the survival of Convertibility in the long run). Argentine wage levels in the set of tradable branches in 1991 accounted for 44% of US levels; by 2004, that ratio had fallen to 22%. Thus, this particular element of Argentina's trade competitiveness was high, at least in relation to the developed world.

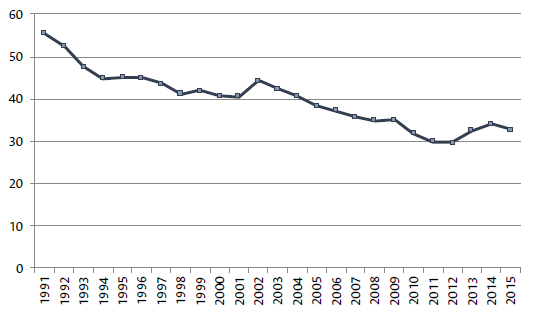

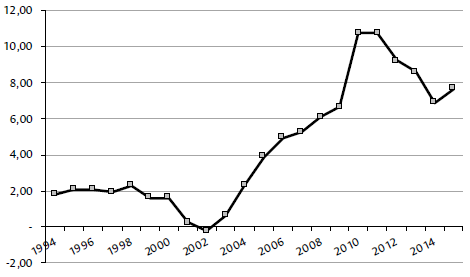

On the other hand, Figure 2 shows the evolution of the vertically integrated productivity of the Argentine tradable sector measured by its inverse: vertically integrated labor requirements per unit of output. Undoubtedly, this indicator improved throughout the period, from 55.45 jobs per million units of product in 1991 to 29.70 in 2015 (a reduction of 46%). However, if we repeat the comparison with the US, these indicators are much higher than those of developed countries. Also noteworthy is that in the 1990s, the differential of this indicator increased between both countries, since the evolution of productivity in the United States was more favorable. Thus, if in 1991 the vertically integrated labor requirements per unit of product in the tradable sector were three times greater in Argentina than in the US, by 2004 this had risen to four times Montanyà (2015, p.12). Thus, the evolution of this Argentina's competitiveness factor, while positive in absolute terms, was based on marked differences with its main developed trade partner, and the comparative evolution was therefore not favorable.

Source: own elaboration.

Figure 2 Tradable sector: vertically integrated labor unit requirements (jobs per million 1993

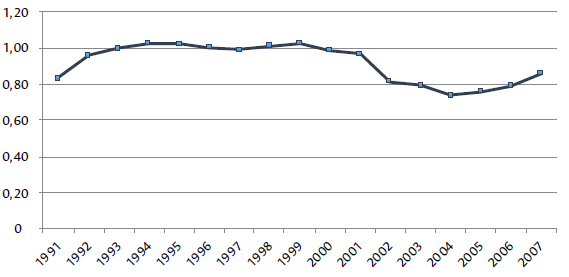

Figure 3 shows the evolution of the quotient between the CPI and the aggregate Producer Price Index in Argentina for the period 1991-2007, beyond which wholesale price data suffer the same reliability problem as the CPI. However, in this case, no alternative calculations have been made for the CPI.

Source: own elaboration.

Figure 3 Tradable sector ratio between the CPI and the sectorial price index (base year: 1993) (so much per one)

After the introduction of Convertibility, several factors, including measures for trade liberalization, led to a change in relative prices in the Argentine economy, reducing the prices of internationally tradable goods and services in comparison to those non-tradable. This situation was maintained during the period of exchange rate anchor, but once Convertibility was abandoned, with consequent devaluation, wholesale prices of tradable sectors increased to a lesser extent than did retail prices conditioned by anti-inflationary measures (such as wage de-indexation) carried out during the prior period. The result was a reduction of the quotient between the CPI and the price of tradable goods.

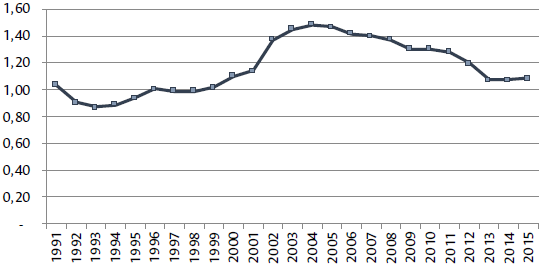

Finally, Figure 4 shows the indicator of vertically integrated unit benefits throughout the period. The upward trend during the Convertibility period would indicate a loss of competitiveness due to the increase in profit margins, whereas during the subsequent period, this situation would have reverted, slowly and partially. However, this indicator, which by design admits narrow discrepancy margins, has a necessarily limited weight in explaining the factors of commercial competitiveness.24

Source: Own elaboration.

Figure 4 Tradable sector vertically integrated profit coefficients (qi) (so much per one)

Analysis of the indicators thus obtained allows us to establish a series of conclusions around the elements of Argentina's commercial competitiveness and their relation with the country's commercial performance during the overall period.

Given the magnitude of the productivity differentials observed vis-à-vis developed countries, the main factor for Argentina's trade competitiveness during the overall period was the large differential in salaries. At the same time, two marked wage devaluations were observed, in 19911995 (of around 25%) and in 2002 (near 13%). Although wages have increased since then, they have not recovered to meet 1991 levels, and this corresponds to an overlarge differential.

The competitiveness sustained by low wages and undermined by an unfavorable comparative evolution of productivity has privileged the labor-intensive sectors and those linked to natural resources. This trend, along with measures implemented in the 1990s, has favored a relative weakening of branches with greater technological content and the progressive reinforcement of dependence on technological imports and capital goods.

During the 1990s, a relative price change, consisting in lowering of tradable goods' prices in relation to those of the economy as a whole, took place in Argentina. Since there was no similar change in the United States' relative prices, this had a negative effect on the competitive capacity of Argentine exports, and this adversely affected trade balances. Nevertheless, there is statistical evidence of this trend being halted during the first years following abandonment of the exchange rate regime.

All of the above entails a series of implications for the financial insertion of Argentina's economy. Branches with lower technological content, being less capital intensive, allowed for faster amortization of investments and greater liquidity, thus contributing to facilitate access to foreign currency inflows necessary to sustain Convertibility (up to 2002) 25 and compensate for the outflows entailed by technological dependence and capital flight. These elements will be dealt with in the following section.

Argentina's external financial insertion

To characterize the financial insertion of the Argentine economy, we analyze those elements that form part of the needs of finance: capital flight, payment of external debt, and the implications of economic policy.

Capital flight and external debt payment have been the commonest results for foreign currencies invested the country, despite changes in indebtedness management following the 2001 crisis that conditioned the entry of capital flows. Analysis of these phenomena is necessary as a counterpoint to theses claiming that these changes fostered financial "independence" (Nemina, 2012). In the area of economic policy, analysis will permit us to determine the extent to which (within the framework of change of orientation) these continues to condition financing needs.

The flight of capital has been a significant characteristic of the Argentine economy since the military dictatorship of the 1970s. Assets that the non-financial sector (NFS) currently maintains abroad are taken into account, since this sector is the main driver of this type of capital outflow.

As displayed in Figure 5, capital flight fell very significantly after the outbreak of the crisis in 2001, initially due to difficulties in the financial market resulting from the crisis. From 2002, a recovery of the economy attracted capital, thus reversing the trend and reaching negative amounts in 2005.

Source: Own elaboration based on BCRA (n.d.) -Report on the evolution of the Single Market for Free Trade and Exchange Balance 2000 and 2016 (Q2).

Figure 5 NFS external asset flows - billion of US dollars (1995-2015) 26

In 2007, coinciding with the beginning of a financial crisis in the US, capital flight reached levels higher than in the previous decade, rising to a total of $8.9 billion at the end of the year. Another explanation for this jump was a change in the calculation methodology for the CPI and its relation to the payment of debt adjusted for inflation ( Levy-Yeyati Bragagnolo, 2012). Thereafter, any change in political or economic decisions generated significant capital flight. In 2008 the economy lost $23.1 billion.

At that point, when in 2011 the flight capital reached $21.5 billion, initial measures were launched by the government to attempt to control access to the foreign currency market. As shown in Figure 5, capital flight fell in 2012 and became slightly negative in 2013, but it was reactivated after 2014.

Some mechanisms continue to function without passing through the foreign currency market, such as those involving the purchase of financial assets abroad, the over- and under-invoicing of imports and exports, or mechanisms related to intra-firm movements. (Gaggero et al., 2010).

The use of royalties, licenses, and other services can serve to increase the amount of foreign currency that can be legally acquired.

A portion of the external resources required to finance an economy comes from foreign investments, which can be short-term (portfolio investments) or long-term (foreign direct investment).

FDI inflows are considered an external financing resource, but they also have certain impact on the outflow of capital in the repatriation of dividends. In the case of Argentina, dividends sent to parent companies began falling from 1998, but in 2002 they reversed course, following an upward path until 2011.

Despite restrictions on the purchase of foreign currencies in the foreign exchange market in 2011, flows continued to be high and had recovered by 2015, when $7.6 billion were sent abroad for the payment of dividends, as shown in Figure 6. Its impact as a means of financing is limited thanks to the high flow of dividend payments abroad. In fact, the dividend payments contribute the Argentina's dependent international financial insertion27.

Source: Own elaboration based on (n.d.c.).

Figure 6 Profits sent abroad - millions of current dollars (1994-2015)

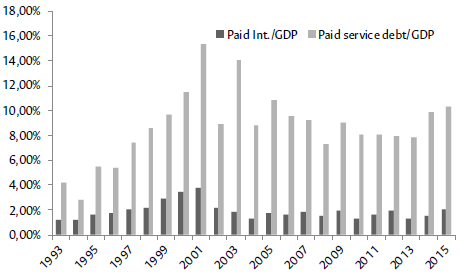

The payment of debt experienced two clearly distinct phases in the period under study. The first phase was the Convertibility regime when external debt was a source for financing and fulfilment of its needs. Since 2002, foreign debt has failed to fulfill both those functions. The Post-convertibility period is characterized by the disconnection of international capital markets and by new debt management based on the restructuring of 2004.

Throughout the 1990s, the external debt continued to grow as a result of the increasing tendency of interest on the fiscal debt. In 1993, interest on debt represented 10% of current income and 28% in 2001.

At the end of 1994, assets that could be privatized were exhausted, and the cancellation of obligations and maintenance of the monetary base coverage required more indebtedness, at rates higher than the international norm. Given the impossibility of financing payment of the debt with the issuance of money, new loans were undertaken that involved still higher interests and deficits, which in turn raised the debt, making its potential profitability more attractive (Rapoport, 2000). Debt growth and imbalances in the external accounts raised the country's risk, which further pushed up interest rates.

The situation became unsustainable, and at the end of 2001, Argentina suffered one of the greatest crises in its history as a result of worsening imbalances caused by the public and commercial deficits. The debt servicing fell sharply in 2002 as the effect of the suspension of debt payments. The measures taken to overcome the crisis and the new debt management opened a new era in the role of public debt.

The debt restructuring in 2005 represented a very significant fall in interest, due to a decrease in the nominal value of the debt in payment suspension, as well as the new rates that were negotiated.

However, as seen in Figure 7, debt servicing reaches similar levels than the financial speculation boom in 1997. The percentage of debt servicing over GDP was then at 7.4%, while in 2012 it reached 7.9% - its lowest percentage since the new management came into effect.

Source: Own elaboration based on Capello and Grión (2010).

Figure 7 Percentage of GDP of interests and services paid (1994-2015)

As far as interest on GDP is concerned, this reached a high point of 3.8% in 2001. Since then, the figure has ranged between 1.2% and 2.1%, very like the percentage sustained until 1998, when the crisis began.

Another factor to consider is the effect of mechanisms introduced by the restructuring, such as the inflation adjustment of certain bonds and the payment of coupons linked to GDP. The first mechanism fundamentally affects the domestic debt in pesos, while the second mechanism affects all holders. The GDP coupon is not considered part of the debt stock as it represents a potential payment. But in truth, $ 9.9 billion was paid between 2006 and 2012. (Zaiat, 2011; IAMC, 2012)

The exit of capital through these mechanisms is not figured as interest or debt service, but it has provided generous returns to holders, implying that it has in some way contributed to the financing needs of the State and, therefore, to the overall economy (Bordón, 2017).

To complete the analysis, certain appreciations must be taken into account that help to clarify the role of debt in this period. First, thanks to the restructuring, the reduction of external debt vis-à-vis total debt has been very significant (external debt as a percentage of the total fell from 59% in 2001 to 28% in 2015, while debt in dollars dropped from 97% to 67% in the same period). But this public debt continues to condition the economy and its liquidity needs, so that beginning in 2009, financial expenses meant the end of fiscal surplus.

Second, payment of the restructured debt was conditioned by economic policy, as evidenced by the reform of the Central Bank's Charter Law, which extends possibilities for financing to the Treasury and eliminates restrictions on the use of reserves for the payment of State obligations. Additionally, the application of BCRA controls for capital outflows responded more to the need to preserve the foreign currency necessary for the payment of debt, and for the continuity of exchange rate policy, than to any intention of eliminating capital flight. This is proven in the fact that implementation of these measures did not correspond to the outbreak of leakages in 2007, but rather to a fall in Central Bank reserves in 2011.

Towards the end of the period, the government made certain decisions that could be interpreted as signals of an inability to persevere in a state of "disconnection" from the international financial system: a compensation agreement was forged with Repsol for the 2012 expropriation of YPF ($5 billion in bonds) in 2014 and the payment to the Paris Club (pending since suspension of payments at the start of the decade), a total debt of $9.69 billion. (Groisman, 2014)

Although the vicious cycle of paying debt through additional debt ceased in 2002, public indebtedness persisted in serving foreign financing needs through restructuring payments made during throughout the overall period (Bordón, 2017). These payments became a priority, and they conditioned decisions taken on economic policy at the very moment when new obstacles began to appear.

Regarding economic policy, during the Convertibility period the sustainability of monetary policy and its effects over tradable goods were included among the needs for financing. In the Post- Convertibility, the Central Bank became one of the main financiers for the State. Domestic borrowing gradually replaced external debt, as restrictions on access to international financing continued. Transitional advances amounted to 14% of total debt in 2013 and 10% in 2015, to which must be added non-transferable bills given in exchange for the use of reserves to pay the debt.

Control of the exchange market became the axis supporting the model's operation. Foreign currencies were necessary, as before, to maintain a policy of intervention that controlled currency parity and allowed for the fulfillment of external obligations.

The tendency toward a current account deficit has conditioned the financial insertion of the Argentine economy, offsetting that negative balance with the inflow of resources by way of the capital account. However, in times of trade surplus, the economy has also required foreign exchange for its operation. Capital flight, debt repayment, and the economic policy itself have all formed a part of those financing needs, thus consolidating the country's present financial insertion.

Table 1 Funding requirements in billion dollars (1994-2015)

| Accumulated values | 1994-200112002-2009 | 2010-20151 2002-2015 | |||

|---|---|---|---|---|---|

| 1 | Current account deficit or surplus | -74,07 | 54,54 | -43,54 | 10,99 |

| 2 | Variation of reserves | -0,15 | 31,22 | -20,75 | 10,47 |

| 3 | Variation of external assets of the financial sector | -1,93 | 2,95 | 0,30 | 3,25 |

| 4 | Variation of external assets of the non-financial sector | -56,34 | -60,86 | -58,84 | -119,70 |

| 5= 1-2+3+4 | Total financing requirements | -132,19 | -34,59 | -81,33 | -115,93 |

| 6 | Portfolio investments in shares | 22,31 | -21,37 | 8,38 | -12,99 |

| 7 | FDI | 56,33 | 30,76 | 57,17 | 87,93 |

| 8= 5+6+7 | Net financing requirements | -53,54 | -3,83 | -24,16 | -27,99 |

| 9 | Variation of total gross external debt | 61,72 | -47,00 | 18,62 | -28,38 |

| 10=9+8 | Difference | 8,18 | -50,83 | -5,54 | -56,38 |

Source: Own elaboration based on INDEC (n.d.c.).

As shown in Table 1, the trade deficit between 1994 and 2001 represented 56% of total financing requirements. Foreign asset holdings in the non-financial sector and capital inflows had similar amount.

According to data from throughout the Post-convertibility period, the flow of foreign investment compensated for financing needs, mainly through the formation of assets of the non-financial sector abroad. On the other hand, the variation in the external debt was a negative effect of the debt management initiated in 2004. This was made possible due to the increase of the internal debt. If we take the effects of exchange into account, the domestic debt has increased by $91.4 billion since 2005, while total public debt between 2005 and 2015 grew by $94.1 billion - very similar figures.28 In this sense the accumulation of reserves has been fundamental, since the main internal financier for the Treasury has been the Central Bank. The evidence of this is the reduction in reserves between the periods 2002-2009 and 2012-2015 (Table 1).

One element remained constant throughout the period: the flight of capital - a structural problem in the Argentine economy that has meanwhile represented one of the most significant determinants of financing needs.

Economic policy, for its part, saw changes before and after the crisis, but it, too, required external financing. In the period of Convertibility, this was due to the need to hedge the monetary base; in Post-convertibility, it was due to the need to maintain the currency and pay down debt.

The main differences between the two periods can be found in the behavior of the current account and in external indebtedness. The 1990s were characterized by a trade deficit, while a good part of the Post-convertibility phase showed a positive current account. Even so, the structural characteristics of the Argentine economy generate a tendency toward deficit of the external accounts. The reasons for this can be found in the country's productive apparatus, dependent on imports of capital goods, and in the volatility of prices for its exports (both primary sector and goods of little added value). This has left the economy in a position of vulnerability in terms of the provision of liquidity through international trade; that, along with capital flight, payments on debt, and the operation of monetary policy all contribute to sharpening Argentina's dependence on external financing.

Conclusions

In light of the evidence presented in this paper, the international insertion of the Argentine economy in the period 1991-2015 must be defined as dependent, both commercially and financially, despite changes that have occurred since the crisis of 2001.

The country's competitiveness, sustained by low wages and by poor evolution of productivity in comparative terms, has privileged the development of labor-intensive sectors and those closely linked to natural resources, further contributing to a relative weakness vis-à-vis sectors producing goods of greater technological content. All this has strengthened Argentina's dependence in terms of technological and capital goods.

The financing needs of the economy - represented by capital flight, the payment of external debt, and the country's own monetary policy - were maintained throughout the period under study. The one element that has marked a major difference between the Convertibility and Post-convertibility periods has been the source of financing: public debt in the 1990s and the current account in most of the 2000s. However, the trend towards trade deficit linked to the specialization of production has forced a return to international capital markets. On the other hand, foreign investments as a source of financing are limited by the outflow of dividends that they generate.

Finally, the influence that both aspects exert through their mutual dependence is here confirmed. Commercial specialization linked to primary and low value-added products contributes to a tendency toward trade deficit, as a result of its effects on technological dependence and capital goods. The country's dependent financial insertion demands, in turn, that liquidity be obtained by way of commercial balance, thus consolidating already existing patterns of specialization.