1. Introducción

The globalization of markets has increased competition among companies, and because of the free market and shocks to macroeconomic magnitudes, these have become more volatile. This leads companies to perform a closer analysis of the environment in which they are located to avoid negative effects on the structure of the balance sheet. It is here where asset-liability management (ALM) presents actions in the search to manage the financial structure of the company's balance sheet.

Following the definition provided by the SOA (2003, p. 2), "ALM is the continuous process of formulating, implementing, monitoring and reviewing strategies related to assets and liabilities, to achieve the financial objectives set for a given set of risk tolerances and constraints". ALM focuses on the asset side, on market, credit, and liquidity risks, while on the liability side, on margin volatilities and costs (Flórez, 2005). In the financial sector, ALM has always been an important problem, becoming more relevant today for researchers and financial decision-makers. From here, the ALM modeling problem in the literature has been classified into two streams: deterministic models or stochastic models (Zopounidis, Doumpos, Pardalos, 2010). This classification is disaggregated along the dimensions of time and uncertainty into Single-period static models, multi-period static models, single-period stochastic models, and multi-period stochastic models (Zenios and Ziemba, 2006). Static models posit that no decision adjustments are accepted after the initial time until the end of the horizon. It is then assumed that there is only one-day t = 0 and that only one initial decision is made against the portfolio. The multi-period models present a more dynamic behavior of the ALM problem, proposing the incursion of decisions regarding the portfolio at different times, t = 1, 2, 3.....T (Flórez, 2005). Mulvey and Ziemba (1998) show how ALM has been treated from different perspectives: static analysis of asset allocation, scenario generation models, dynamic analysis of the portfolio of assets and liabilities, risk treatment, among others.

From these perspectives, stochastic programming is highlighted in ALM problems as it provides a general-purpose modeling framework, which captures real-world features such as turnover constraints, transaction costs, risk aversion, limits on asset pools, and other considerations. However, the optimization model is unwieldy for the sheer number of decision variables, especially for multi-stage problems. One of the first industrially applied models of this type was the stochastic linear programming model with simple recourse developed by Kusy and Ziemba (1986). This model captures certain characteristics of ALM problems: it maximizes revenue for a bank under the legal, policy, liquidity, cash flow, and budget constraints to ensure that the deposit obligation is met as far as possible (Bajram and Can, 2013).

According to Ahmad, Naveed, Ahmad and Butt (2020), there are two types of literature review: the traditional review and the systematic review. In the former, ideas published by other researchers are summarized, analyzed, and critically evaluated, here mainly the selection is made subjectively. In the second, defined search, data extraction, and presentation techniques are used. The review of the existing literature for ALM has not detailed comprehensive approaches that identify a systematic review under a bibliometric analysis of research in the area. This article aims to fill the gap in the ALM literature review, for a better understanding of the research lines and methodologies. We use the information contained in the Scopus database and we provide a content and topic modeling analysis of the top 100 articles with respect to the average number of citations per year. Thematic models are common in text mining, since they allow the discovery of semantic structures found in texts.

The article is structured in additional sections to the introduction, following: The second section presents the research methodology, where the selection of bibliometric data is specified in detail, as well as the bibliometric techniques. The third section shows the bibliometric results of the analysis of citations, the fourth section the analysis of topic modeling, and finally, the main conclusions and findings are socialized, as well as the limitations of the study and recommendations for future research in this line.

2. Research methodology

In this study, the literature review of ALM is investigated using a systematic literature search. Since multiple databases are containing bibliometric type information, it was determined to work with the Scopus database. Falagas, Pitsouni, Malietzis and Pappas (2008); Franceschini, Maisano and Mastrogiacomo (2016); Garousi and Mäntylä (2016) determined that Scopus is more accurate than databases such as Web of Science (WoS) or Google Scholar (GS), as it poses as a reliable midpoint between the citations presented by GS and WoS. Although GS has a larger scope in all areas concerning WoS or Scopus, the citations presented by GS do not always come from journals that generate quality problems when assessing scientific impact (Martín-Martín, Orduna-Malea, Thelwall and Delgado 2018). On the other hand, WoS provides citation quality information by presenting a publication count in the WoS journal index, however, Scopus reports higher metrics than WoS (Harzing and Alakangas, 2016).

A total of 1702 documents were found in Scopus using the relevant keywords: Asset, Liability, and Management. It was found that this search yields results that can be confusing when requiring specific information on ALM. Therefore, the following search equation was established: "Asset*-Liabilit* Management". Here it was possible to direct the results specifically to the ALM topic, controlling the search by means of possible variations in the terms. A total of 416 documents were listed under the search equation. Finally, in the next step, the search was filtered only for article and review type documents obtaining a final sample of 324 articles in a total of 171 journals with a time window from the year 1983 to 2021. The search and download were performed on January 21, 2021, finally using the following equation: TITLE-ABS-KEY("Asset*-Liabilit* Management") AND (LIMIT-TO (DOCTYPE, "ar") OR LIMIT-TO (DOCTYPE, "re")).

For the bibliometric analysis, we use the Bibliometrix library of R developed by Aria and Cuccurullo (2017) who provide bibliometric tools for mapping scientific production with a great potential to introduce systematic review processes, with transparency and above all reproducibility. Data mining is used to extract useful information from the text data of the most cited papers, according to the main research topics or trends. The TF-IDF (Term Frequency and Inverse Document Frequency) statistic proposed in the 1980s by Salton and Buckley (1988) is used to measure the importance of a word for a document within a collection of documents, which determines the most representative terms or words within a document by their relevance rather than by their frequency. According to Silge and Robinson (2017), the tf-idf statistic is a rule of thumb; while it has proven useful in text mining, search engines, or other scenarios, information theory experts consider its theoretical foundations to be shaky. The inverse document frequency for any given term is defined as equation 1:

In addition, using topic modeling, which is an unsupervised classification method, the extraction of words that allow inquiring about latent themes or general research trends in the most cited articles is performed. According to Jelodar et al. (2019) in topic modeling, a topic is a list of words that appear in statistically significant methods. This assumes that any part of the text is combined by selecting words from possible sets of words. One of the most widely used methods in topic modeling is Latent Dirichlet allocation (LDA), first presented by Blei, Ng, Jordan (2003), here topics are presented according to the probabilistic distribution over relevant words within the corpus set of documents. Following Blei et al., (2003) given a corpus D consisting of M documents, with document d has N d words (d Є 1.....M)the probability of the observed data is calculated and obtained from a corpus by equation 2:

Where the process is followed: Choose a multinomial distribution ( t for the subject t (te 1,...,T) from a Dirichlet distribution with parameters β. Choosing a multinomial distribution θ t for document d (del,..., M) from a Dirichlet distribution with parameters α. And finally, for a word w n (n Є 1,...,Vd) in document d: a) select a topic zn from θ t, b) select a word w n from ( t . One has then that documents are observed variables, while p and θ t latent variables, and α, β hyperparameters of the model. The variables z dn , w dn . are word-level variables.

3. Results and discussion of citation analysis

3.1. Timeline of publications and citations

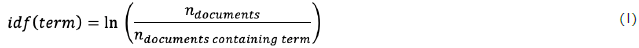

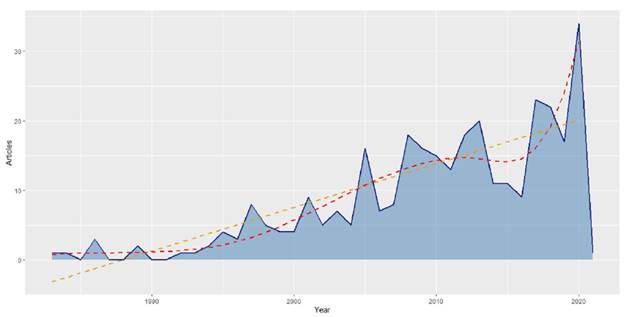

The initial results show coverage of 38 years from 1983 to 2021 identifying an average number of years of publication of 10.6, which indicates that for the journals studied the literature usually cited has a scope of about 10 years. The average number of citations per published article is 10.73. There are a total of 8650 references for the 324 documents in the sample. The total number of authors is 599 and the average number of authors per article is 1.88. The collaboration index, which is calculated as the total number of authors of multi-authored papers (609) over the total number of multi-authored papers (287), was 2.12. Figure 1 shows the annual trend of publications indicating large variations throughout the study period. The yellow line adjusts a linear trend and the red line a smoothed spline trend, it can be seen that there is no relatively constant growth in the production of information on ALM, on the contrary, a smoothed trend identifies growths in the production of articles in the periods 2000-2013 and 2015-2020. Figure 2 shows the average number of citations per year where it is distinguished that over the years the average number of citations of the articles has decreased, clearly the most recent articles will have a lower number of citations compared to the older ones. The yellow dots show the 5 articles with the highest number of citations. The year with the highest average number of citations (59.3) was in 1986 because of the article Bank Asset and Liability Management Model by Kusy and Ziemba (1986) which has 156 citations and was published in the journal Operations Research. This paper is the initial benchmark of the ALM literature, here the authors developed a multi-period stochastic linear programming model to determine the optimal trade-off between risk, return and liquidity, they concluded that ALM is superior to other deterministic models generating superior policies.

Source: Own elaboration

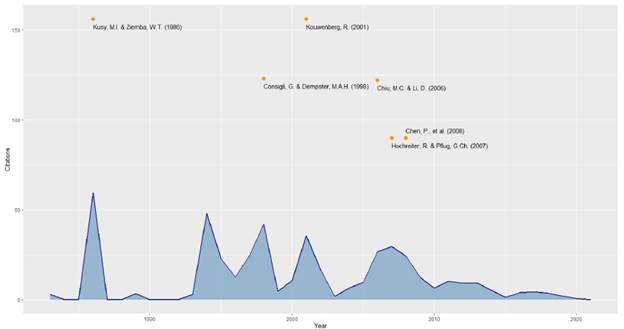

Kouwenberg (2001) also presents an article with 156 citations, this work focuses mainly on developing and testing different scenarios for asset-liability management models applied to a pension fund. The high variations in Figure 2 are because it is precisely in these years that the most cited articles are presented, except 1994 for which there is no widely cited article. Figure 3 presents the cumulative citations for 5-year periods (blue dots), in which the period from 2005 to 2010 stands out with a total of 1156 cumulative citations, which shows that ALM papers from 2010 onwards are largely based on recent publications between 2005 and 2010. In this period there is a great influence by Asian authors such as Li, D., Chiu, MC., Li, Z., Xie, S., Besides there are also Austrian authors such as Hochreiter, R., and from India Purnanandam, A. and Sodhi, S. The topics investigated by these authors were oriented towards optimization problems under mean-variance criterion, stochastic problems under scenario generation, interest rate risk management.

On the other hand, Figure 3 shows in orange dots the information presented in Table 1, which lists the most representative articles in the number of citations for each period. The article that stands out with the highest number of citations in the period with the most elevated number of accumulated citations (2005-2010) is the work of Chiu and Li (2006) with 122 total citations, which aims to analytically solve the ALM problem in a continuous-time environment using the efficient mean-variance frontier.

It is worth noting from Figure 1 that in this period there was an average volume of article production which, when related to the accumulated citations of the same period, shows that this period was vital for the generation of knowledge in the area of ALM. A striking scenario is a very high gap concerning the accumulated citations from the period 2005-2010 to 2010-2015 since there is a decrease of more than 50%, this is presented due to the vast development of mathematical models in the period 2005-2010, which generates the need in subsequent periods to widely cite these developments. A total of 3475 accumulated citations are presented for the 324 documents under analysis, giving an average of 10.73 citations per document.

Table 1 Most cited articles published within 5 years

| Period | Authors | Title | Citations |

|---|---|---|---|

| 1980-1985 | Goodman and Lanqer (1983) | Accounting for interest rate futures in bank asset liability manaqement | 3 |

| 1985-1990 | Kusv and Ziemba (1986) | A bank asset and liability management model | 156 |

| 1990-1995 | Brivs and De Varenne (1994) | Life insurance in a contingent claim framework: pricing and regulatory implications | 69 |

| 1995-2000 | Consiqli and Dempster (1998) | Dynamic stochastic programming for asset-liability management | 123 |

| 2000-2005 | Kouwenberg (2001) | Scenario generation and stochastic programming models for asset liability management | 156 |

| 2005-2010 | Chiu and Li (2006) | Asset and liability management under a continuous-time mean-variance optimization framework | 122 |

| 2010-2015 | Chen and Yanq (2011) | Markowitz's mean-variance asset-liability management with regime switching: A multi-period model | 47 |

| 2015-2020 | Wei and Wang (2017) | Time-consistent mean-variance asset liability management with random coefficients | 23 |

Source: Own elaboration

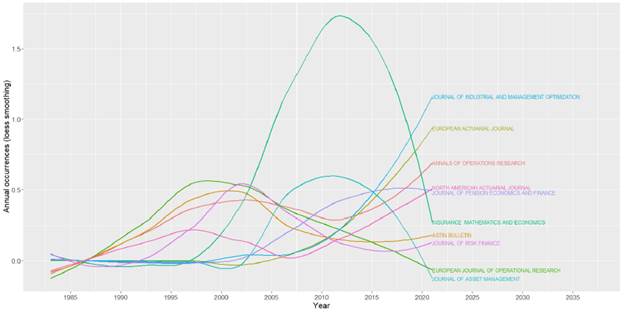

Figure 4 shows the growth of the 10 journals with the highest number of publications during the time window studied. It can be seen how growth curves were observed around the year 2000 for the journals European Journal of Operational Research, Astin Bulletin, Journal of Risk Finance. Subsequently, around the year 2010, there was growth in the journals Insurance: Mathematics and Economics and Journal of Asset Management presenting large decreases in publications in the last 5-year period (2015-2020).

Finally, for the year 2021, growth is observed in journals such as the Journal of Industrial and Management Optimization, Annals of Operations Research, European Actuarial Journal, North American Actuarial Journal, and Journal of Pension Economics and Finance. It is shown then that over time there have been three booming publication seasons for the journals: 2000's, 2010's and 2020's, the latter being in active growth.

3.2. Most relevant journals

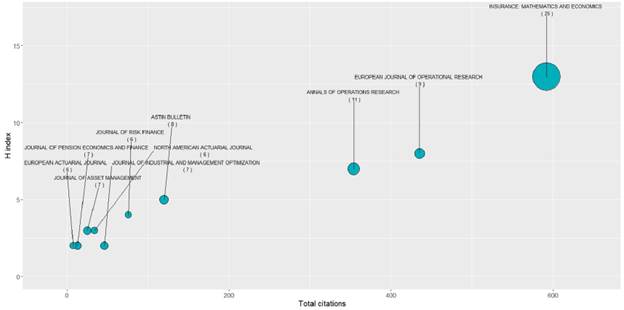

The articles that have published topics on ALM are housed in 171 journals from 1983 to 2021 according to the Scopus database. Among these journals, some of the highest-ranking ones stand out, which have allowed wide visibility of the topic. Figure 5 presents complete information regarding the analysis of the total number of citations (x-axis), H index (y-axis), and the number of publications on ALM (number in parentheses in the label, dot size) for the 10 most relevant journals. It is interpreted from this graph that the journals Insurance: Mathematics and Economics, European Journal of Operational Research, and Annals of Operations Research have been the journals with the highest impact. Of these three, the journal Annals of Operations Research is currently in a growing trend of dissemination of ALM research. It is identified that the number of publications per journal (number in parentheses in the label) is not a determining factor in the journal's impact factor.

Table 2 complements the information in Figure 5 where the number of journals analyzed is increased to 20. It is observed that the 5 most influential journals have older starting dates in terms of publication of articles on ALM topics. In this Table shows that journals such as Journal of Industrial and Management Optimization, Journal of Asset Management, and Journal of Pension Economics and Finance present a number of 7 publications, which is an average value compared to the other journals, but they do not have a high influence on ALM topics, since their H index and the total number of citations is not high. These journals started publishing in ALM around 2007 - 2010.

3.3. Most relevant authors

Table 3 presents the 20 most relevant authors in ALM topics. The order presented is linked to the total number of citations of each author. The top 5 most influential authors in ALM are Chiu M.C., Li D., Chen P., Consigli G., and Mulvey J.M., Of this set of authors only Mulvey J.M. has written a paper as the sole author. The authors with the highest number of publications are Chiu M.C. and Li D. with 7 papers each. Concerning these two authors, Chiu M.C. has more influence since his dominance factor is 1.0. The dominance factor is a ratio that indicates the fraction of multi-author articles in which a scholar appears as the first author (Aria and Cuccurullo 2017). Among the top 20 most relevant authors, the author with the longest tenure in ALM activities is Mulvey J.M. in 1994 (127 citations - 6 articles); the author with the most recent start of ALM activities is Pan, J. in 2017 (20 citations - 5 articles).

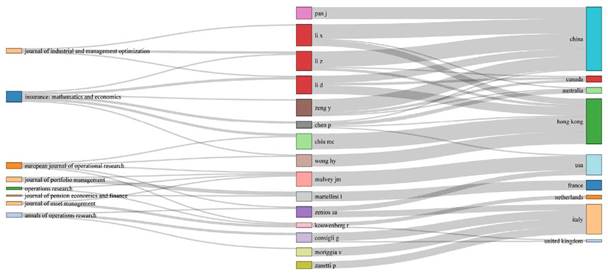

Figure 6 shows the most outstanding relationships between authors, journals, and country of origin according to author affiliation. The most relevant relationships are presented for authors with affiliations to institutions in China, who mostly present publications in journals such as the Journal of Industrial and Management Optimization and Quantitative Finance. Of the relevant authors in this country, Li D., who presents institutional relationships with China and Hong Kong, stands out. Authors with institutional affiliations in Hong Kong mostly have publications in the journal Insurance: Mathematics and Economics, of which Chiu M.C., Li D., and Chen P. stand out. There are also authors related to the USA, such as Mulvey J.M., and Zenios S.A., who publish mostly in the European Journal of Operations Research, Journal of Asset Management, and Operations Research. Finally, the author Consigli, G. from Italy, who publishes in Annals of Operations Research, stands out. There is a clear trend in Asian countries for the development of mathematical models to optimize the ALM problem.

3.4. Most relevant papers

This section presents the top 20 most relevant articles on specific ALM topics. Table 4 shows in column APY: the average number of citations per year, in column TC: the total number of citations, in addition to information such as title, authors, journal, and year of publication of the article. Since an article published many years ago may have a higher cumulative number of citations compared to a recently published article, it is necessary to compare and generate the ranking of outstanding articles using APY. The most relevant article has been "Asset and Liability Management Under A Continuous-Time Mean-Variance Optimization Framework" with an APY of 7.6, published by Chiu and Li (2006) in the journal Insurance: Mathematics and Economics. According to Figure 2, this article is the fourth most cited article with a total of 122 cumulative citations since 2006. This result shows that the production of the last 15 years has been widely influenced by mathematical developments focused on the use of techniques such as mean-variance. The second relevant article belongs to Kouwenberg (2001) "Scenario Generation and Stochastic Programming Models for Asset Liability Management" with an APY of 7.4. The third article "Markowitz's Mean-Variance Asset-Liability Management with Regime Switching: A Continuous-Time Model" follows the line of research on mean-variance oriented models. Another result that is evident in Table 4 is that 7 of the 20 most relevant articles are published in the journal Insurance: Mathematics and Economics. The article with the highest number of citations (156) "Bank Asset and Liability Management Model" (Kusy and Ziemba, 1986) is ranked 13th with an average number of citations per year of 4.3.

The most relevant cited references within the document collection are not necessarily part of the set of documents resulting from the search equation. That is, it measures how many times an article included in the references of the document collection has been cited by the articles included in the collection. The most cited reference (15 citations) is A Theory of the Term Structure of Interest Rates (Cox, Ingersoll, Ross, 1985) published in Econometrica. Portfolio Selection (Markowitz, 1952) published in the Journal of Finance is also the most cited with 15 citations. This is followed by Optimal Dynamic Portfolio Selection: Multiperiod Mean-Variance Formulation (Li and Ng, 2000) published in Mathematical Finance with II citations, as well as the article "Asset and Liability Management Under A Continuous-Time Mean-Variance Optimization Framework" with II citations published by Chiu and Li (2006) There is a clear and strong influence of references to portfolio selection models using mean-variance techniques.

3.5. Most relevant co-occurance keywords

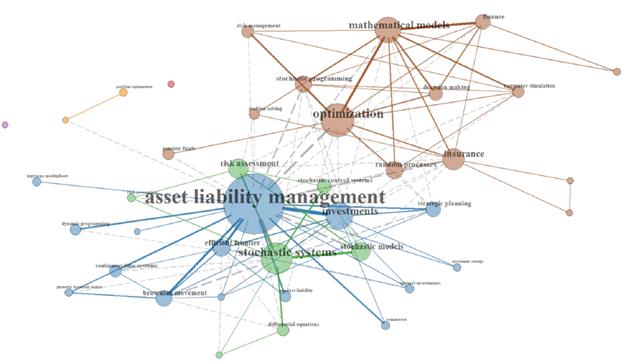

Figure 7 corresponds to the co-occurrence analysis of the author's keywords. This shows the map of relationships of terms of major interest in ALM topics. As expected, the term "asset liability management" can be seen at the core of the map, as it is transversal to all the nodes or topics addressed in the research. Three major clusters can be distinguished, the first one associated with specific asset-liability management topics (blue color), the proximity and strength marked with the investments node, efficient frontier, dynamic programming, which means that most of the production is related to investment strategies approached from dynamic analysis evaluating different periods, different asset classes and dynamic flows that generally represent the preferences of investors. Another relevant cluster is mainly marked by the term "optimization" (brown color), within which relationships with mathematical models, insurance, finance, stochastic programming are identified, showing a production trend oriented to an optimal allocation under stochastic processes in areas such as finance and insurance. And finally, the cluster (green color) is more oriented to stochastic modeling and risk assessment.

Source: Own elaboration

Figure 7 Bibliometric map of most frequently mentioned author keywords from 1983-2021

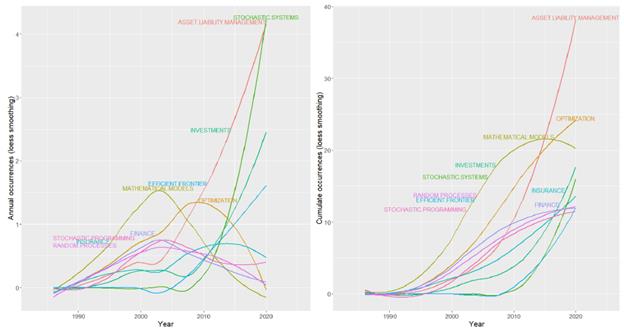

Figure 8 shows the dynamics in the author keywords from 1983 to 2020. The left panel shows the annual co-occurrences while the right panel shows the cumulative co-occurrences. It is identified in the left panel that in the last period the most common terms refer to Asset Liability Management and Stochastic Systems. In the 2000s the most frequent topics were associated with Mathematical Models and Finance. Around 2010 the trending topics were associated with Optimization and Insurance. The right panel shows that the three most worked trends over time have been Asset Liability Management, Optimization, and Mathematical Models.

4. LDA topic modeling and content analysis

Figure 9 presents the top 10 most important words measured from the tf-idf statistic for the top 20 most relevant articles. The main findings are summarized in the identification of words associated with mathematical modeling, statistics, and optimization topics: programming, test, switching, theorem, Markov, mean, var, distribution, moments, MASS, simplex, cointegration, granger, Poisson, mathematics, optimization, among others. Another scenario identified is the focus on populations such as clients, holders, Indonesia, BPRS (Rural Bank in Indonesia), investors, banks, users, china, hong kong. Other aspects highlighted in the most relevant words are financial and economic issues: efficient, pension, wages, capital, capital, regime, bills, bonds, commodities, risky, microfinance, monetary, macroeconomic, insurer, Basel, regulation, structural, governance, elasticity. All the above determines a research approach by mathematical modeling under stochastic and optimization criteria in pension funds and banking sectors for the financial sectors in Asia.

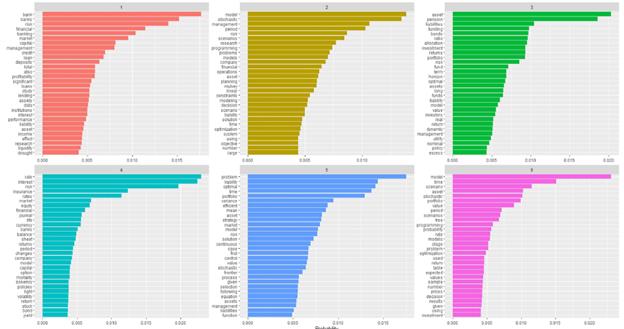

Documents 13, 18, and 20 presented inconsistencies in their reading due to the document download format, which does not allow importing the text content of the article. The LDA model revealed 6 latent topics in the top 100 most cited articles. Figure 10 shows the identification of words by topics, topic 1 is oriented under a research approach in the banking sector: Financial risk management in the capital market for banks associated with scenarios of loans, credits, deposits, profitability, liquidity, among others. The second topic is oriented under a research approach in stochastic modeling: Stochastic models in programming and optimization problems under constraints for different financial scenarios. The third topic is oriented under a research approach in the pension funds sector: Allocation of assets and liabilities in pension funds forming investment portfolios under different horizons expecting returns. The fourth topic is oriented under a research I approach in the insurance sector: Relationship between the capital market and the insurance industry, extremely linked by the behavior of the interest rate, incursion of risk diversification policy to increase the solvency of insurance companies. The fifth theme is oriented under a research approach on mean-variance problems: Mean-variance analysis in the choice of portfolios and capital markets. And finally, the sixth topic is oriented under a research focus on general optimization models in ALM: Techniques for optimal portfolio management.

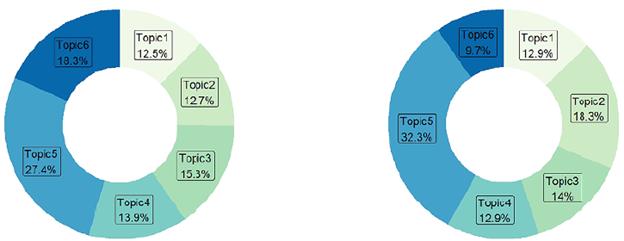

Since an article may contain different topics from those listed above, we sought to identify the most likely topics that determine the top 100. Figure 11 in the left panel shows the probability of a topic occurring in the entire top 100 collection. It then shows that Topic 5: Mean-Variance Problems (27.4%) is most likely to occur, followed by Topic 6: General Optimization Models in ALM (18.3%). This shows that it is more likely to find in the ALM literature topics focused on the use of quantitative techniques.

Source: Own elaboration

Figure 11 Left panel: Probability of topics occurring within all 100 articles. Right panel: Distribution according to the dominance theme of the 100 articles

On the other hand, the right panel of Figure 11 presents the classification of the collection of articles according to the most relevant topic of each article individually. Approximately 32.3% of the articles in the collection are classified in Topic 5: Mean-Variance Problems, followed by 18.3% of the articles classified in Topic 2: Stochastic Modeling.

Table 5 (see annexes) shows the distribution of the collection of the top 100 articles. The grouping was made according to the predominant topic of each publication. The information presented in Table 5 is Rank: Represents the ranking of the article within the top 100; First Author: The main author of the article; Year: Year of publication and Prob: Probability estimated by the model for the classification of the article in the predominant topic.

5. Discussion

Although the ALM theory has several decades of development since the 1980s, where Kusy and Ziemba (1986) stands out as one of the first works, to date it has not been possible to generate a large number of studies. Management has been perceived more in theoretical works that involve stochastic optimization, where works aligned with continuous mean-variance models, Markowitz models, multi-criteria models stand out. Therefore, the theory has been mathematically and statistically driven. This matter is confirmed by the type of journals where the publications have been made Insurance: Mathematics and Economics, European Journal of Operational Research, Annals of Operations Research, Operations Research, among others.

ALM needs to expand its lines more towards the own management of companies and empirical developments. Management data play a very important role here: profitability, solvency, liquidity, etc. Where, through statistical and econometric methodologies, the contrast of hypotheses is generated that can be input by decision-makers, politicians, managers, and academics. This development will further drive ALM to embrace other lines of research and new publication opportunities.

From here, the discussion opens on new research in different fields that provide companies with more complete answers in an economic environment, for example, improving solvency levels by taking advantage of opportunities in the market within acceptable risk limits, such as interest rate risk, exchange rate risk, liquidity risk, and credit risk. These strategies used must guarantee the profitability scenario according to the risks assumed. Fundamentally, the reaction of companies to macro financial changes lacks indepth research, part of which makes it necessary to study the different behaviors in ALM strategies in the face of macroeconomic shocks, prioritizing management efficiency.

In addition, the approach of future research should involve the evaluation of individual behaviors at the business level, as well as at the sectoral level. This must contemplate hypotheses of the type of joint management by type of financial sector. Biases in the conformation of portfolios under home-bias scenarios must be evaluated in the management of assets and liabilities, where despite the diversification of the portfolio under financial internationalization, investors are biased by possible macroeconomic states to allocate their investments mainly at the local level, thus determining the conformation of portfolios, which implies that ALM management may present different sensitivities in its strategy. Finally, the ALM literature has not been dedicated to a generalized analysis under an economic approach on emerging and developed economic structures, this gap generates a striking challenge to be faced by new researchers, since the various sectors of banking, insurance, and pensions can vary their management strategies due to various factors that may be sensitive to the type of economy that is present, which a comparative analysis would complement the ALM literature.

6. Conclusions

The main objective of this article was to review the literature related to ALM, being a pioneer in the incursion of bibliometric analysis and modeling of topics in the area of ALM. In the results, different statistics were identified that allow elucidating that specific research in ALM, despite having its beginnings in the 1980s, has not been widely addressed in the literature. The results show that there are illustratively 6 research topics in the ALM literature: Financial risk management, Stochastic modeling, Pension funds, Capital markets and the insurance industry, Mean-variance models, General optimization models. This shows that the literature is mainly focused on mathematical and statistical modeling research for ALM problems. That is, quantitative research has been widely exploited. This work provides a clear picture of the behavior of research trends over a time horizon. It contributes from the bibliometric approach to the contextualization of the metadata statistics of the ALM article collection, and under text mining techniques it complements the content analysis by revealing the different topics on which the authors have focused. Thus, from this work, gaps in the ALM literature can be identified according to the line of research to be addressed by future authors. In recommendations for future research, this work can be extended to strengthen the literature under citations from other databases such as Google Scholar or WoS.